by Elizabeth Hines | May 11, 2016 | Blog, Strategy, Supply Chain

If Seneca the Elder could have peered into the future, shock is likely too weak of a word to describe his reaction. The Roman rhetorician is credited for being among the first to complain about the overload of information when he, in the 1st century AD, lamented that the abundance of books had become a “distraction.”

Around 1440 AD, another round of complaints erupted with the invention of the printing press. Overwhelmed by the sheer amount of new information, scholars of the Gutenberg era found the proliferation of printed materials too difficult to manage.

Fast-forward a few centuries and you find articles titled “Death by Information Overload.” Published in 2009 by Harvard Business Review, the article makes a case that we’ve heard countless times over the past few years: We are drowning in a flood of data.

However, the writer, Paul Hemp, also makes a point that I want to focus on:

There’s hope, though. Innovative tools and techniques promise relief for those of us struggling with information inundation. Some are technological solutions—software that automatically sorts and prioritizes incoming e-mail, for instance—designed to regulate or divert the deluge. Others prevent people from drowning by getting them to change the way they behave and think. Who knows: Maybe someday even I will enjoy swimming in the powerful currents of information that now threaten to pull me under.

Nearly two years ago, I argued in this space that vendors would be wise to spend less time on their sales pitch and more time presenting data in a digestible format, ensuring compatibility with the end-user’s legacy systems, and aligning the solution with the end-user’s key performance indicators (KPIs).

Few people actually object to the value of data, and most are well informed of its potential impact, according to several surveys. Collected in a warehouse environment, data can profoundly boost productivity, safety, and inventory accuracy.

The issue that many still need to address is that all too often the step from collecting data to letting it drive decisions is more than the average organization can handle. Surveys show a surprising number of companies report they are either wary of advanced analytics tools or have failed to leverage the technology. Data generated by sensor-enabled technology, for example, does little good unless the end-user knows how to interpret and act on it.

But there are signs vendors are responding to the demand for user-friendly data. Just as you do not expect to sort through masses of data to find out how fast you are driving, leading vendors are eliminating and simplifying steps to help end users get the information that they are looking for without time-consuming analysis. New widgets or apps designed to consolidate data coming off multiple sensors will make data collection in the warehouse more accessible, and, as a result, more likely to lead to operational improvements.

Then talk of data overload may quiet down — until the next wave of disruptive innovation hits, that is.

What signs, if any, have you seen of more user-friendly data?

This article originally appeared in EBN Online.

by Elizabeth Hines | May 10, 2016 | Blog, Strategy, Supply Chain

Increasing operational expenses to avoid capital expenditures that would boost warehouse capacity and functionality might end up costing you more in the long run.

Consider this scenario: Demand is up and projected to grow for your products. But you are running out of space in your distribution center. Although you realize modernizing your distribution center to increase productivity would make sense, you resort to the seemingly more affordable solution — hiring more workers.

While many companies may balk at the upfront cost of investing in, for example, warehouse automation technology, holding off on upgrading in the name of saving money can become a costly long-term strategy.

Don’t get me wrong. Automation is not always the answer to tackling issues that stem from rapid growth, but companies need to be aware that doing nothing also comes at a cost. Increasing operational expenses to avoid capital expenditures that would boost warehouse capacity and functionality is generally not a good idea. More workers on the floor mean more congestion and delays, in addition to increasing the risk of higher turnover rates, as new employees are more likely to move on than longer-term associates.

In the end, if your productivity and order fulfillment suffer as a result of your inaction, so will your customer relationships.

FORTE, a Swisslog Company, made the following observation in SupplyChain 24/7:

Businesses routinely choose to not invest in distribution without giving careful consideration to the impact on operational costs and missed business opportunities. They thoroughly evaluate whether to purchase material handling equipment, warehouse software and distribution buildings. The same scrutiny should be applied to real and often hidden expenses and the opportunity costs of the option to do nothing.

In FORTE’s case, the company came to the “rescue” of a retailer who had planned to respond to a significant increase in demand and SKUs by hiring more workers to the tune of $900,000 to $3 million per year. Although labor costs would more than double, the retailer would still struggle to fulfill and deliver new orders on time. After much debate, senior management decided to spend $5 million on new material handling equipment and software to meet current and future demand.

So what issues can arise from the do-nothing strategy?

Well, take your pick among unwanted scenarios: Bottlenecks in pick zones; safety concerns as a result of increased congestion; double-handling due to an inability to confirm picks; discrepancies in putaway, replenishment, and picking stemming from the lack of automatic data capture and real-time tracking; and dropping productivity as employees, among other things, have to travel further to retrieve items.

If you have reached a point where you miss or ship incorrect orders, and adding labor seems to only compound the challenges, it is time to take a serious look at your priorities. Perhaps, investing in automation is finally justified?

This post originally appeared in EBN Online.

Related posts:

by Fronetics | Jul 16, 2014 | Blog, Manufacturing & Distribution, Marketing, Social Media, Strategy, Supply Chain, Talent, Warehousing & Materials Handling

According to the 2013 CareerBuilder Candidate Behavior Study, job seekers looking for a position with the manufacturing, transportation, and warehousing industries are using the internet and social media not only to look for jobs, but also to research companies within these industries.

Candidates use the internet and social media throughout their job search

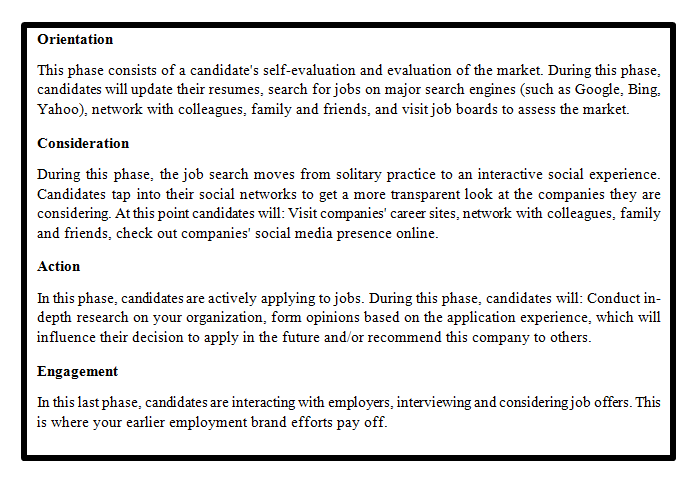

The CareerBuilder study looked at the behavior of candidates throughout the four phases of their job search (orientation, consideration, action, and engagement) and found that the internet and social media were used throughout each of the phases. (See Figure 1 for a definition of each of the four phases.)

Figure 1: The four phases of the the job search

Source: 2013 CareerBuilder Candidate Behavior Study

Source: 2013 CareerBuilder Candidate Behavior Study

Job seekers in the orientation and consideration phases have not yet applied for a job at your company. Instead they are assessing the market, learning about an industry, and learning about companies within the industry. These stages are very much knowledge seeking phases for the candidate. Companies who are positioned right can attract great talent during these phases. However, companies who do not have a strong online presence and who do not participate in social media will not catch the eye of job seekers. Think of it as speed dating – you only have a short period of time to make an impression. According to the Neilson Norman Group you have 10 to 20 seconds to make that great impression. If you don’t make a great impression during those few seconds the user will navigate away from your website. Therefore you need to make sure that your website is visually engaging, easy to navigate, and contains quality and informative content.

When a candidate reaches the action stage they not only apply to jobs, they also conduct more in-depth research about a company, and form opinions based on the application experience. Candidates are not afraid to share their experience with the application process. Fifty percent of candidates share bad experiences with others and 64 percent share positive experiences.

In the engagement stage candidates interact with employers, interview for positions, and consider offers. Ninety-one percent of candidates believe employment brand plays a role in their decision whether or not to apply – therefore it is at this stage where your company’s online presence and participation in social media pays off.

How do candidates looking for a position within the manufacturing, transportation, and warehousing industries approach their job search? Let’s look.

Manufacturing industry

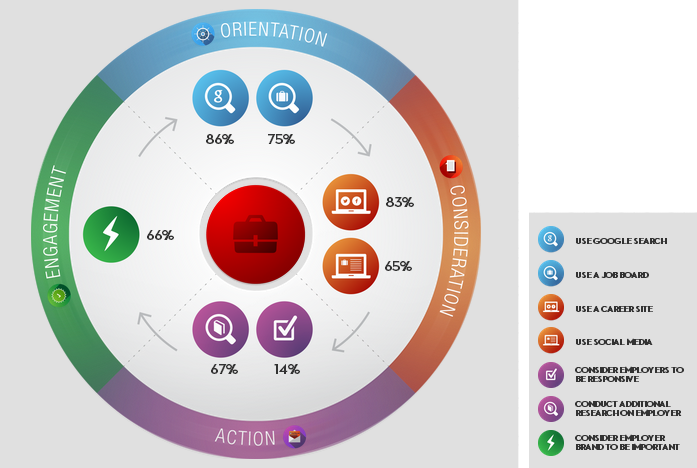

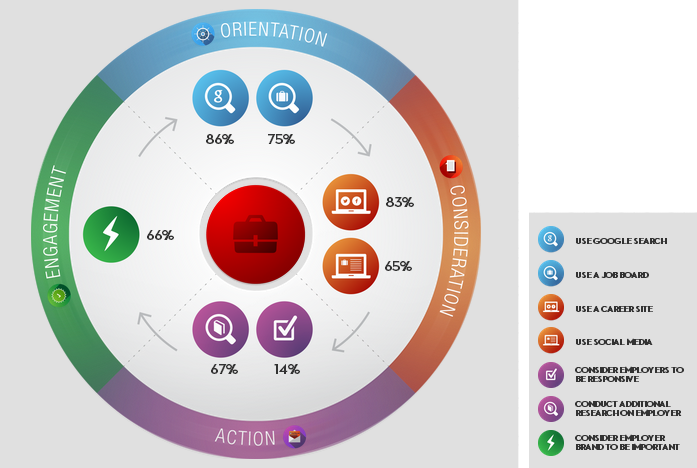

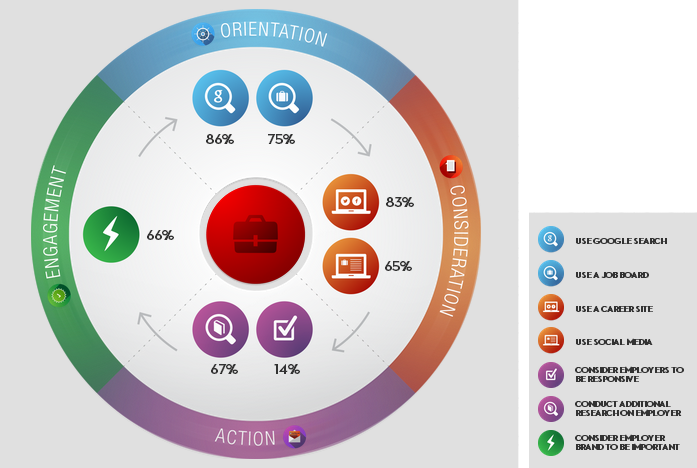

As shown in Figure 2, within the orientation stage, 85 percent of candidates looking for a job within the manufacturing industry turned to Google and 75 used a job board. In the consideration stage 83 percent used a company’s career site and 65 percent used social media to learn more about the company.

In the action stage 67 percent of candidates reported that they conducted additional research on an employer. In this stage only 14 percent of candidates reported employers in the manufacturing industry to be responsive.

Finally, looking at the final stage of the candidate’s journey, 67 percent reported that they felt the employer brand to be important.

Figure 2: The four phases of the job search; manufacturing industry

Source: 2013 CareerBuilder Candidate Behavior Study

Transportation and warehousing industries

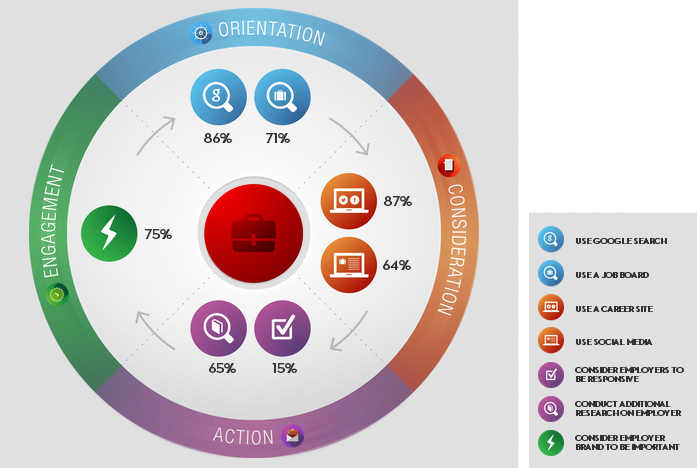

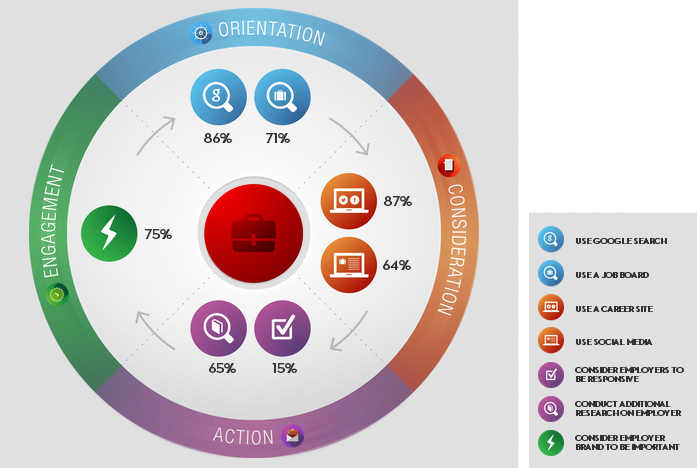

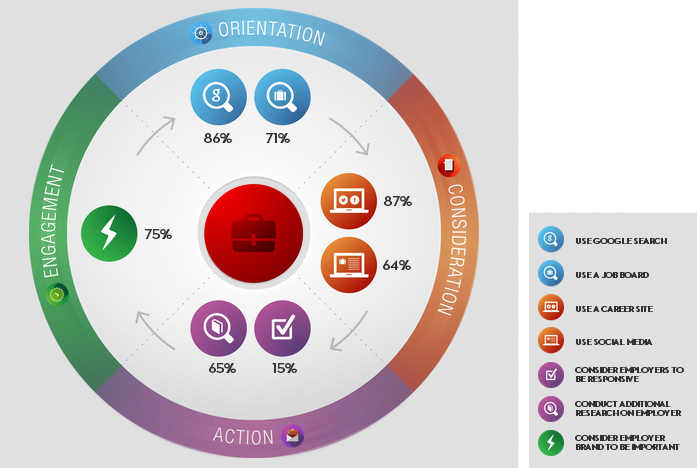

Figure 3 shows that within the orientation stage 86 percent of candidates looking for a job within the transportation and warehousing industries turned to Google and 71 percent used a job board. In the consideration stage 87 percent used a company’s career site and 64 percent used social media to learn more about the company.

In the action stage 65 percent of candidates reported that they conducted additional research on an employer. In this stage only 15 percent of candidates reported employers to be responsive.

In the engagement phase, 75 percent of candidates reported that they felt the employer brand to be important.

Figure 3: The four phases of the job search; manufacturing industry

Source: 2013 CareerBuilder Candidate Behavior Study

In the end

Candidates looking for jobs within the manufacturing, transportation, and warehousing industries are using the internet and social media. They are researching these industries and researching companies within these industries. They are forming opinions, acting on these opinions, and sharing their opinions with others.

If the manufacturing, transportation, and warehousing industries want to attract great talent and retain their interest throughout a candidate’s job search they need to invest in their online presence and become active in social media.

by Fronetics | Jul 16, 2014 | Blog, Manufacturing & Distribution, Marketing, Social Media, Strategy, Supply Chain, Talent, Warehousing & Materials Handling

According to the 2013 CareerBuilder Candidate Behavior Study, job seekers looking for a position with the manufacturing, transportation, and warehousing industries are using the internet and social media not only to look for jobs, but also to research companies within these industries.

Candidates use the internet and social media throughout their job search

The CareerBuilder study looked at the behavior of candidates throughout the four phases of their job search (orientation, consideration, action, and engagement) and found that the internet and social media were used throughout each of the phases. (See Figure 1 for a definition of each of the four phases.)

Figure 1: The four phases of the the job search

Source: 2013 CareerBuilder Candidate Behavior Study

Source: 2013 CareerBuilder Candidate Behavior Study

Job seekers in the orientation and consideration phases have not yet applied for a job at your company. Instead they are assessing the market, learning about an industry, and learning about companies within the industry. These stages are very much knowledge seeking phases for the candidate. Companies who are positioned right can attract great talent during these phases. However, companies who do not have a strong online presence and who do not participate in social media will not catch the eye of job seekers. Think of it as speed dating – you only have a short period of time to make an impression. According to the Neilson Norman Group you have 10 to 20 seconds to make that great impression. If you don’t make a great impression during those few seconds the user will navigate away from your website. Therefore you need to make sure that your website is visually engaging, easy to navigate, and contains quality and informative content.

When a candidate reaches the action stage they not only apply to jobs, they also conduct more in-depth research about a company, and form opinions based on the application experience. Candidates are not afraid to share their experience with the application process. Fifty percent of candidates share bad experiences with others and 64 percent share positive experiences.

In the engagement stage candidates interact with employers, interview for positions, and consider offers. Ninety-one percent of candidates believe employment brand plays a role in their decision whether or not to apply – therefore it is at this stage where your company’s online presence and participation in social media pays off.

How do candidates looking for a position within the manufacturing, transportation, and warehousing industries approach their job search? Let’s look.

Manufacturing industry

As shown in Figure 2, within the orientation stage, 85 percent of candidates looking for a job within the manufacturing industry turned to Google and 75 used a job board. In the consideration stage 83 percent used a company’s career site and 65 percent used social media to learn more about the company.

In the action stage 67 percent of candidates reported that they conducted additional research on an employer. In this stage only 14 percent of candidates reported employers in the manufacturing industry to be responsive.

Finally, looking at the final stage of the candidate’s journey, 67 percent reported that they felt the employer brand to be important.

Figure 2: The four phases of the job search; manufacturing industry

Source: 2013 CareerBuilder Candidate Behavior Study

Transportation and warehousing industries

Figure 3 shows that within the orientation stage 86 percent of candidates looking for a job within the transportation and warehousing industries turned to Google and 71 percent used a job board. In the consideration stage 87 percent used a company’s career site and 64 percent used social media to learn more about the company.

In the action stage 65 percent of candidates reported that they conducted additional research on an employer. In this stage only 15 percent of candidates reported employers to be responsive.

In the engagement phase, 75 percent of candidates reported that they felt the employer brand to be important.

Figure 3: The four phases of the job search; manufacturing industry

Source: 2013 CareerBuilder Candidate Behavior Study

In the end

Candidates looking for jobs within the manufacturing, transportation, and warehousing industries are using the internet and social media. They are researching these industries and researching companies within these industries. They are forming opinions, acting on these opinions, and sharing their opinions with others.

If the manufacturing, transportation, and warehousing industries want to attract great talent and retain their interest throughout a candidate’s job search they need to invest in their online presence and become active in social media.