by Jennifer Hart Yim | Aug 7, 2014 | Blog, Marketing, Social Media, Supply Chain, Transportation & Trucking

This guest post is written by Keychain Logistics. Keychain Logistics is a leading transportation provider enabling businesses to directly engage carriers, track shipments, and monitor its logistics needs online.

It’s 2012. Platforms like Uber, Airbnb, and Homejoy are growing rapidly. New customers are signing up via search, paid referrals, and social media. Marketing teams at each are delicately balancing the supply and demand of their output with a spread of calculations that, if not projected carefully, may lead to service outages and upset customers.

Now what’s going on here, and what does this have to do with logistics?

The companies above, alongside many others eating the world today with software, are all marketplaces.

Speaking in online terms, a marketplace is where buyers and sellers of a particular product or service can collaborate in a streamlined process to achieve what they want from the other side.

In exchange for facilitating relationships, thus saving time and resources for the entities wanting to connect, marketplaces may charge subscription fees, transaction commissions, or depend simply on high traffic volume to sell other assets like media space or proprietary content.

But facilitating relationships is only a necessary component, and not a sufficient one, to the success of a marketplace. This is because some buyers and sellers feel that the benefit of a marketplace has been fully realized upon their connection, and thus don’t stick around for the platform to send a bill.

What marketplaces must do to maintain engaged users, then, is create experiences inside the application that remove the incentive to circumvent it. And this is a tough challenge to solve.

One great example of this is Odesk.com, a marketplace connecting freelancers with employers who have projects to outsource. In exchange for this service, Odesk charges a 10% fee to employers per transaction. While this may sound steep, Odesk meets this ask with a suite of free management tools such as random monitor screenshots that let employers track the productivity of an outsourced team member without worrying about being overbilled on hours.

For freelancers, Odesk requires employers to place valid credit cards on file pre-hire, protecting them from employers who might otherwise attempt to avoid a payment. Tools like this make the Odesk platform (and its fees) worth every penny, thus creating a winning marketplace that helps both sides get what they deserve.

That said, let’s get back to logistics and how Keychain Logistics fits into this marketplace, value-adding, supply and demand spectrum.

The transportation industry is one of the largest, oldest conglomerates on the planet, with millions of drivers and thousands of shippers and brokerages in the US alone. The industry is also a fragmented one, with the biggest brokerage only commanding ~3% market share.

If anything is clear about business, it is that markets become more efficient through consolidation. From Coca-Cola buying a new beverage brand to a toy manufacturer owning its own factories, market consolidation is a common practice and, if done right, typically results in positive benefits for end-customers such as lower prices, higher quality, and so forth.

But for a myriad of reasons we won’t go into today, this kind of consolidation has yet to happen in the transportation industry.

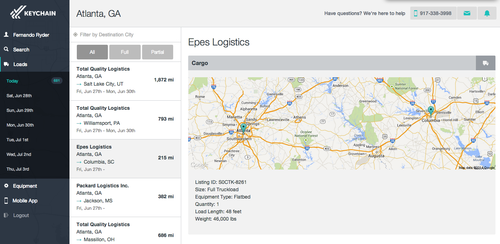

Introducing Keychain.

Keychain is a marketplace connecting drivers directly with shippers, and the benefits are three-fold:

1. Shippers (effectively, employers) can bypass expensive commissions by man-powered brokerages,

2. drivers can book loads while on the go, and

3. Keychain verifies user insurance policies and other legal compliance measures, prior to allowing entry to the platform.

To achieve the win-win harmony of a successful marketplace, not only does Keychain facilitate the relationships but it also addresses the circumvention component with tools for drivers and shippers such as mobile apps, online dashboards, easy payment gateways, and in-app communications between parties.

Keychain is the technological consolidation of a market that just won’t give up its antiquated methods. Together, we can bring much needed efficiency to the efficiency business: logistics.

by Fronetics | Apr 8, 2014 | Blog, Content Marketing, Logistics, Marketing, Social Media, Strategy, Supply Chain

Content is king. By creating and distributing valuable and relevant content in a strategic and consistent manner you will be able to create demand for your products and services and will be able to drive profitable customer action. That being said, while content is king, content doesn’t go far (actually it goes nowhere) without distribution. Wise words by BuzzFeed’s Jonathan Perelman: “Content is king, but distribution is queen and she wears the pants.”

For content to be successful for your business you need to do more than create content – you need to distribute content. Moreover, the content needs to be delivered consistently over time, at the right time, and in the right place.

For your company this means taking the time to identify the distribution channels that are the right fit for your company, your content, and your goals. It also means taking the time to learn how to distribute content via these channels effectively.

For example:

- LinkedIn and Twitter are good candidates for letting people know about the white paper your company just released, whereas Pinterest is probably not a good white paper distribution channel.

- Levering your 140 characters for Twitter is key, but taking those same 140 characters to LinkedIn or Facebook will likely result in you falling flat.

- Distributing your content multiple times a day via Twitter is essential given the short lifespan of a Tweet; however, distributing content multiple times a day via email will not be well received.

Content will help you move the needle. Content will drive profitable customer action. However, your content, no matter how valuable it is, will not be seen and therefore will not be effective if you do not have a solid content distribution strategy. If you want results, remember who wears the pants.

This post was first published on DC Velocity.

by Fronetics | Apr 8, 2014 | Blog, Content Marketing, Logistics, Marketing, Social Media, Strategy, Supply Chain

Content is king. By creating and distributing valuable and relevant content in a strategic and consistent manner you will be able to create demand for your products and services and will be able to drive profitable customer action. That being said, while content is king, content doesn’t go far (actually it goes nowhere) without distribution. Wise words by BuzzFeed’s Jonathan Perelman: “Content is king, but distribution is queen and she wears the pants.”

For content to be successful for your business you need to do more than create content – you need to distribute content. Moreover, the content needs to be delivered consistently over time, at the right time, and in the right place.

For your company this means taking the time to identify the distribution channels that are the right fit for your company, your content, and your goals. It also means taking the time to learn how to distribute content via these channels effectively.

For example:

- LinkedIn and Twitter are good candidates for letting people know about the white paper your company just released, whereas Pinterest is probably not a good white paper distribution channel.

- Levering your 140 characters for Twitter is key, but taking those same 140 characters to LinkedIn or Facebook will likely result in you falling flat.

- Distributing your content multiple times a day via Twitter is essential given the short lifespan of a Tweet; however, distributing content multiple times a day via email will not be well received.

Content will help you move the needle. Content will drive profitable customer action. However, your content, no matter how valuable it is, will not be seen and therefore will not be effective if you do not have a solid content distribution strategy. If you want results, remember who wears the pants.

This post was first published on DC Velocity.

by Elizabeth Hines | Oct 22, 2013 | Blog, Leadership, Strategy, Supply Chain

Source: Simply Silhouettes

Within the logistics and supply chain industries, the key to providing your client with an end to end valuable offering is providing the core value yourself and outsourcing the rest. Finding the right outsource partner is critical to success. Here are seven things you need to consider when choosing a new outsource partner.

1. Culture and values

Choosing the right partner goes beyond capabilities. You have to consider the corporate culture as well. In addition to being able to do the work, the ideal partner should be able do it seamlessly by fitting with your team and with your client’s needs.

When evaluating a new outsourcing partner, it is important to look at their mission or value statements. How do these hold up to your own company’s mission and value statements? Are they well aligned? If they are, move on and explore the company further. If not, walk away. Mission and value statements speak to the core culture of the company, so if you can’t find common ground here, it is unlikely you will be able to build a positive working relationship.

2. Standards and metrics

What standards of quality and delivery does the potential partner employ? Here it is important to look at their metrics and processes. How do these compare with the ones within your company? If they are similar, it is not only likely your systems will be able to work well together, but also likely that the two companies have a similar approach to standards of quality and delivery.

3. Investments

Next, take a look at where the potential partner has made investments. Has the company spent in similar areas to your company? Similar investments show business culture or strategy alignment. If the investments are different, find out why.

4. Financial stability

What is the financial health of the potential partner? You don’t want to enter into a partnership only to find out in a few months that the company is not financial stable. Entering into a partnership with a company that does not have its financial house in order is a costly mistake. Take the time to do your due diligence.

5. Where will you stand?

What will your relationship be? That is, will you be a small fish in a big pond or a big fish in a small pond? When times are good this doesn’t matter, but when there is a customer satisfaction issue, it can mean the difference between client retention or client attrition. It is essential to know where you stand inside your partner’s organizational priorities. If you are comfortable with where you will stand, that’s great. If not, find another partner.

6. Long-term strategy

It is also important to look at the long-term strategy of your company and your potential partner’s company. Does the service they will be providing on your behalf align with their continuing plans? And with your ongoing plans? Continuity and service development is important to your company and to your customers. The potential partner needs to be able to provide the specified service for the foreseeable future and also needs to be able to grow with your company’s strategic needs.

7. Credibility

Finally, look to social media. What are others saying about your potential partner in an unfiltered environment? Are people pleased with the service the company provides? Are there any red flags with respect to the company or the service they provide? Social media can help call attention to potential issues.

Also talk with others within the industry – especially people who have worked with the potential partner before. What was their experience? Again, look for red flags.

By following these steps, you’ll be able to better evaluate potential partners and identify partners that are a good fit from both a business and cultural perspective.