by Jennifer Hart Yim | Jun 26, 2014 | Blog, Internet of Things, Logistics, Manufacturing & Distribution, Marketing, Social Media, Strategy, Supply Chain

This article is part of a series of articles written by MBA students and graduates from the University of New Hampshire Peter T. Paul College of Business and Economics.

Supply Chain Management will use the Internet of Things to improve factory workflow, increase material tracking, and optimize distribution to maximize revenues.

“Clap on “(clap, clap), “Clap off” (clap, clap), “the Clapper”!!

When introduced in 1986, “The Clapper” light switch was considered a significant breakthrough in home automation. Today, with advances in communication, sensors, and internet-connected devices, you can change the temperature of your home, your lights, appliances, and security system all from your smartphone — from anywhere in the world. This is just one simple example in the growing “Internet of Things” technology. The potential is enormous, not just in home automation but in industrial applications like manufacturing and distribution.

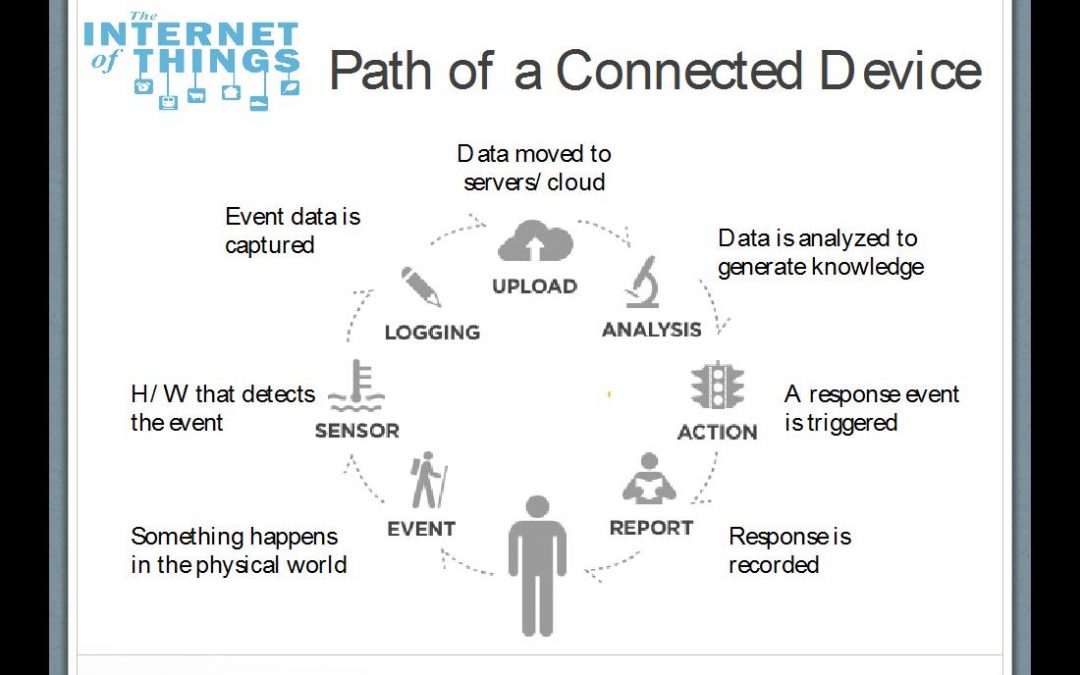

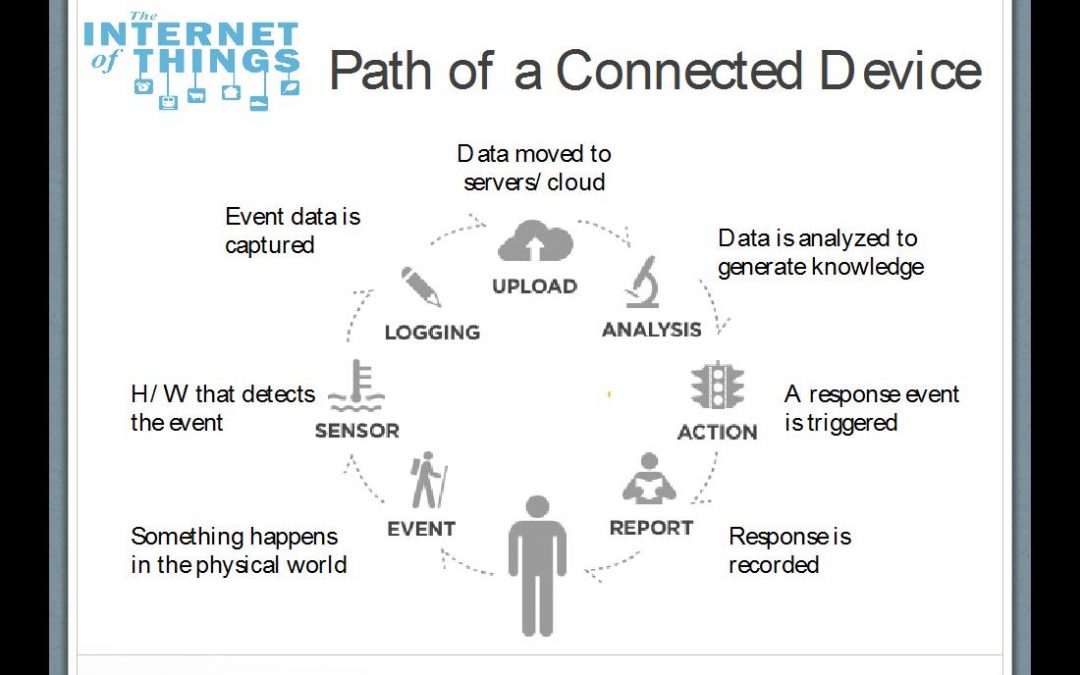

The Internet of Things (IoT) is broadly defined as the merging of the physical and digital worlds. It’s a scenario in which people and/or objects can be uniquely identified with the ability to share information over a network without any actual conscious intervention. The data is automatically transferred, analyzed, and used to trigger an event. Figure 1 below demonstrates how one of these devices functions and interacts with the Internet and other devices.

Figure 1.

The IoT and Supply Chain Management

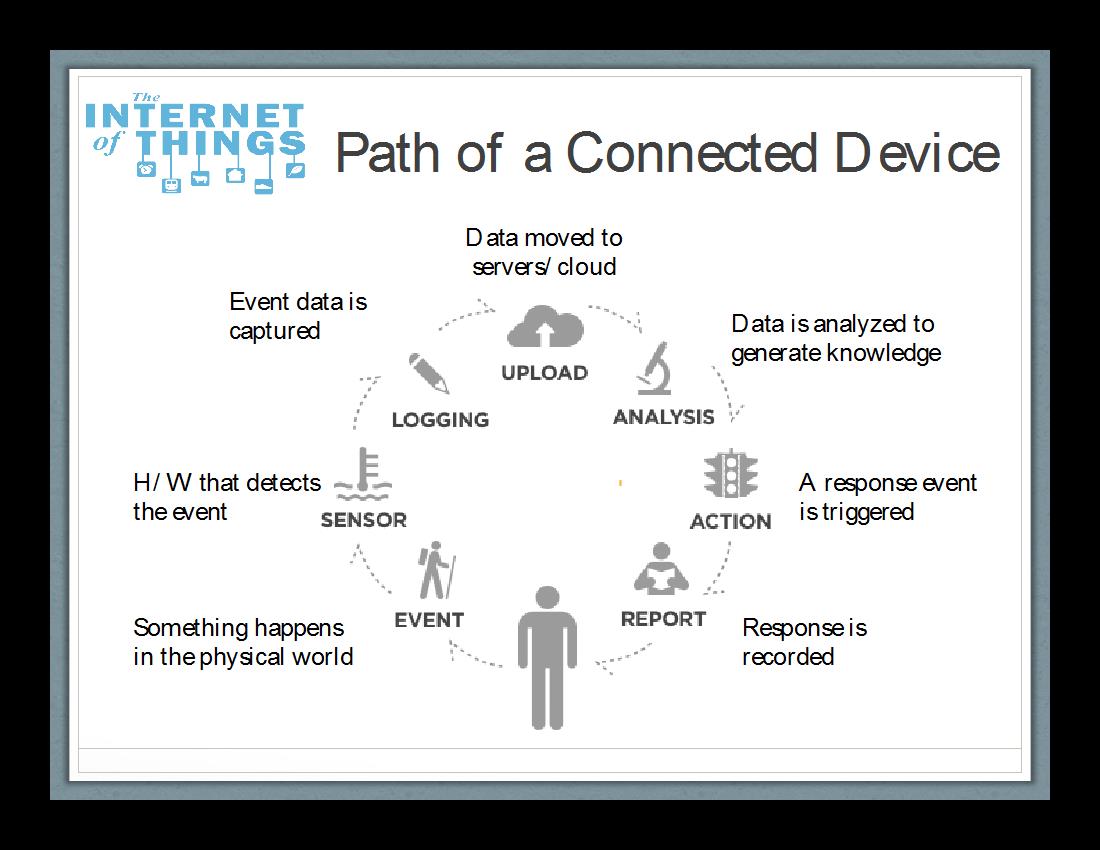

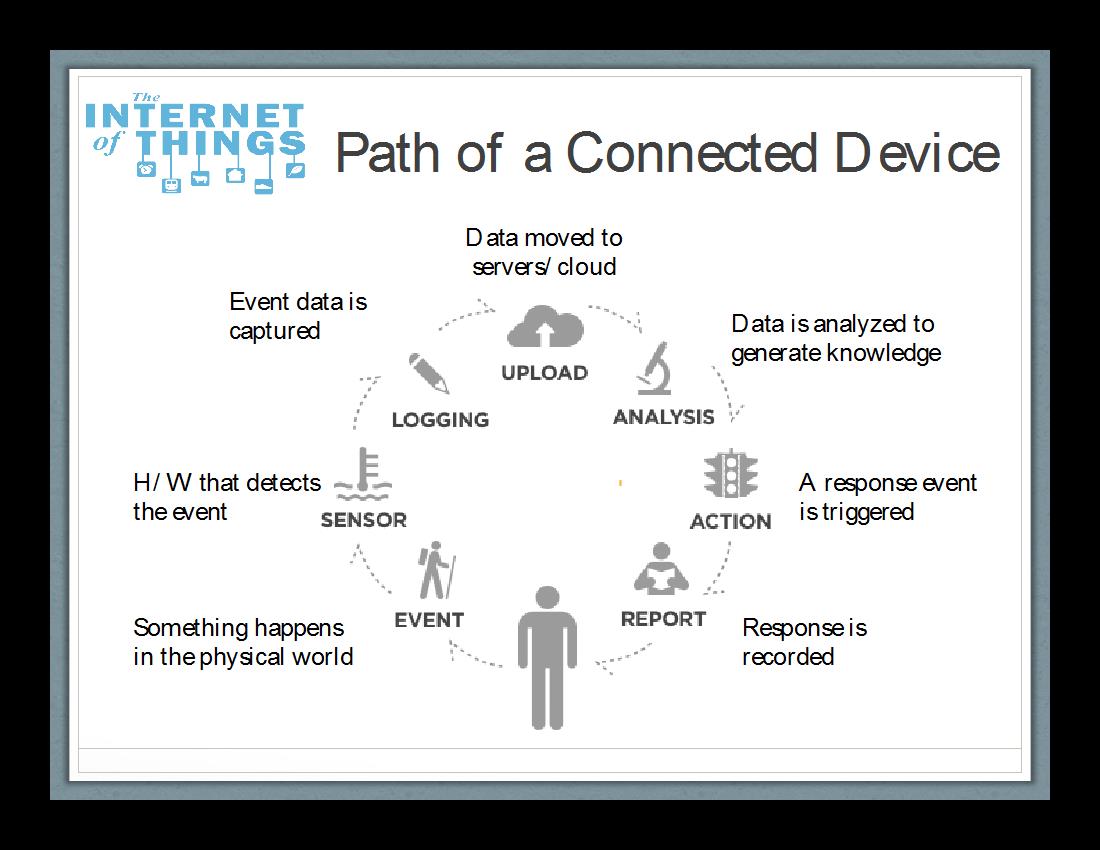

While many of us may be familiar with recent advancements in home automation, like the Nest thermostat, the real impacts of IoT will be in Supply Chain Management. Recent reports by Cisco, IDC and Gartner all claim that a significant increase in the number of devices making up the Internet of Things will have a profound impact on how future supply chains will operate. The 2011 Cisco report predicts there will be 50 billion connected devices globally by 2020, or about 6.5 devices for each person, up from only approximately 2.5 today (see figure 2). More active devices means more available data — to the point where they will be ubiquitous and transparent in our every day lives.

Figure 2.

Impacts to supply chain will be broad and far-reaching, utilizing Big Data to gather and analyze information across the entire process.

Some IoT devices have been in place for some time, such as commercial telematics now used in trucking fleets to improve logistics efficiency. Other commercial type applications — like fabrics that use sensors within clothing and industrial fabrics to monitor human health or manufacturing processes — are just being developed now.

Mark Morely of GSX, a leading provider of monitoring and management solutions, recently discussed three key impacts he believed IoT would have on the Supply Chain industry: Pervasive Visibility, Proactive Replenishment, and Predictive Maintenance. This is a great way to explain the immediate benefits, so I will summarize Mark’s description and expand with some real-world examples.

Three key impacts the IoT will have on the supply chain industry

1) Pervasive Visibility

Mark describes this as the ability to track and monitor a shipment in real time using a combination of sensors (RFID), connected devices, and communication channels (3G/4G, GPS, internet). It provides the ability to have real-time transit status, including location, temperature, and diagnostics — far more information than legacy infomatics provided.

One great example I found is from a company called Purefresh, who are at the cutting edge of Supply Chain IoT technology. They offer not only real-time shipment condition tracking, but also the ability to model and develop transit routes to optimize freshness in perishable cargo — taking into account environmental elements, such as ozone, atmospheres, and temperature. They indicate that an estimated “30% to 50% (or 1.2-2 billion tons) of all food produced on the planet is lost before reaching a human stomach.” IoT advancements will not only better optimize transit flow but also better serve humanity.

2) Proactive Replenishment

It’s the capability to automatically recognize the need to order and restock a product on a “machine-to-machine” basis, reducing the need for human interaction. The most common example is that vending machines will know when it’s out of or low on a Snickers bars and immediately trigger an alert to reorder them, instead of waiting for a service person to check on the vending machine and reorder products manually. The result is less human intervention, quicker replenishment, better sales forecasting and ultimately increased revenues. Oh, and many more happy office workers who really need a mid-afternoon sugar rush!

Opportunities for this technology go far beyond the candy vending machine though. Industries with time critical inventories like hospitals and pharmacies can better maintain supplies by supplementing human inventory control with real time use tracking. A much less critical but more broadly used application comes from Coke’s Freestyle fountain soda machine. It’s about the same size as the existing vending machines but it can dispense 126 kinds of flavors, offering an almost infinite amount of combinations. It uses Radio Frequency ID (RFID) cartridges that store the concentrated syrups in the machine. The RFID chips detect how much of each syrup it has and what combinations are being used. When it detects that it needs supplies, it transmits the information to both Coca-Cola and the storeowner including what has been sold, a record of when sales occurred, troubleshooting information, and service data. As a result, soda sales and customer satisfaction increases, all with less effort by the storeowner.

3) Predictive Maintenance

This application is closer to the true machine-to-machine communications the IoT was intended for. From large-scale manufacturing to diagnostics on the family minivan, predictive maintenance utilizes sensors and connected devices to monitor and react to issues. This self-diagnosis capability can detect a potential issue before there’s a failure, order a replacement part, and even schedule maintenance to avoid costly downtime.

Not only does predictive maintenance help keep factories running longer and the family minivan from unexpectedly breaking down, it can improve efficiency throughout the whole supply chain. If equipment manufacturers constantly receive service data from factory equipment, they can better trend problems and focus on those issues for future products. Parts depots can better forecast inventories and determine consistent safety stock levels. IoT, in this example, is a true B2B (business to business) — automating the communication between businesses on every link of the chain.

In relation to home automation, predictive maintenance will become integrated into our everyday lives. Appliances will become smarter, more efficient, and easier to monitor. Internet-connected sensors will be embedded into everything from refrigerators to washers/dryers and HVAC systems. So much so that companies like GE are investing heavily into these technologies, in both commercial and industrial applications. These connected appliances will perform self-diagnosis, determine the most cost-efficient time to operate, and even automatically order maintenance parts like furnace filters when needed. Imagine getting an alert on your smartphone that your forced hot air furnace needs a new air filter, and it has already been ordered through your Amazon account. It just saved you effort in remembering to check the filter and ordering it — leading to a cleaner, longer-lasting, and more efficient furnace.

So, why isn’t IoT here yet?

It’s close but there are still hurdles to overcome. In recent years, advances in sensor technologies, 4G communications, and cloud computing has made achieving Internet of Things capabilities even more possible. But for companies in the Supply Chain to leverage these opportunities, they will need to expand investment into cloud-based platforms that can support scalable devices and data-analysis services.

Critical to IoT’s success will be the necessary “middleware” software communication protocols to link all these devices. Companies like ProSyst and open-source SW projects like OPENIoT are pioneering these capabilities. But even with this progress, agreements on industry standards will be key to long-term platform success.

Having a common IoT protocol will be necessary to link the physical and digital worlds on a consistent and economical basis. Understanding the need for standards and common architectures, Intel has led the way by recently creating the not-for-profit Industrial Internet Consortium (IIC) with other vested companies like AT&T, Cisco, GE, and IBM. The connected Supply “Chain” will become exponentially longer once these common standards are in place.

The Internet of Things trend is quickly approaching and will impact the way we live and work through increased productivity and efficiency. Supply Chain Management will continue utilizing these advanced technologies to improve factory workflow, increase material tracking, and optimize distribution to maximize revenues.

In 1986, I recall how innovative I thought the Clapper was — I couldn’t have imagined how connected we would become only 28 years later. And the next 28 will be sure to amaze.

Steve Mondazzi is a Principal Master Planner in the Defense Contracting industry. After 20 years’ experience in project management and schedule development, he decided to further his education by recently earning a Masters in Technology Management at the University of New Hampshire. He’s a certified PMI Project Management Professional, an entrepreneur, and an avid lover of all things technology. He currently resides in Massachusetts with his wife, two teenagers, and an excessive collection of headphones. Steve can be contacted via his Twitter account @schedulepro or through LinkedIn.

Related posts:

by Jennifer Hart Yim | Jun 12, 2014 | Blog, Data/Analytics, Strategy, Supply Chain

This article is part of a series of articles written by MBA students and graduates from the University of New Hampshire Peter T. Paul College of Business and Economics.

Regularly tracking your relationship with your suppliers and their performance toward your expectations is critical to ensure the success of your business. One mechanism for tracking this is the supplier scorecard. A scorecard is in essence a report card for your supplier. Supplier scorecards when used effectively can help maintain a healthy supply chain and will benefit both parties. If not used effectively supplier scorecards can damage the supplier relationship and hurt both businesses.

Effective scorecards should use meaningful metrics. If it doesn’t align with business goals then it shouldn’t be measured. Easily measured variables of no importance will just cause clutter; they could also cause a supplier to focus their performance in areas that do not matter. If the metrics are not clearly defined and understood by the suppliers then it will be hard for them to adjust their performance in these areas. Another consideration is there may be things that are important to you which your suppliers have no way of measuring or attaining the performance you are asking for.

As with all business to business relationships communication is critical for maintaining and improving supplier performance. To ensure suppliers meet your needs you should communicate to them from the offset how their performance will be measured. You can even tie bonuses and penalties into their performance scores. You should be mindful that your relationship with your supplier should be collaborative; as you grow so should they. You should share the results of your scorecards with your suppliers on a regular basis and shouldn’t wait until a review to raise a concern. Another important aspect of communication is sharing your business objectives and performance data with your suppliers. This can help them to better shape their business to meet your needs as your business fluctuates.

It is important when evaluating suppliers to have a good process in place for tracking important metrics. When possible it is best to use accurate data that is understood by both you and your supplier. If you use fuzzy metrics which are subjective then improvements become difficult to measure and target. Also, tracking metrics throughout the scoring period will help to ensure the data is accurate and your scorecard reflects actual performance.

When dealing with different suppliers it is important to make sure the metrics you are evaluating are relevant to each supplier. As a result it is not recommended to use a one size fits all approach to supplier scorecards. Another thing to keep in mind is that you may be sourcing from the same supplier through multiple locations. It is important to track each of these on its own scorecard to help your supplier learn where they are doing things right and where they are falling short of your expectations.

Where I work we have several strategic supplier partnerships. The way we manage supplier relationships is through quarterly business reviews with each of our partners. In these meetings high level representation from both companies is present. We share with our partners our business results and forecasts in addition to any major company news. After sharing this information we review our scorecard process with the suppliers, show a score card comparison, take a detailed look at each rating, and then provide an overall summary.

Our scoring system looks at aspects of quality, delivery, cost, support, and inventory management. With respect to quality we look at hard numbers like failures out of the box and returns from our customers. We take into account both product quality and process quality. When it comes to delivery we measure on-time delivery, missed shipments, and lead times. Some of our customers have long term fixed cost agreements so this metric isn’t required, for others the cost fluctuates; we measure whether or not their costs are in line with our expectations. Support has several levels including technical support, order support, and special cases. Inventory management tracks how well they are able to maintain some inventory on hand for us.

Our scorecard metrics used to be scored on the basis of a five point scale from far below expectations to far above expectations. After running through several of these scorecards we determine that it was not likely to get exceeds expectations because the only time expectations could be exceeded is if our demand was well above our forecasts. Since this goal wasn’t something attainable by a supplier of their own action we adjusted our scorecard to have only three levels, from below expectations to meets expectations.

The scorecard comparison is unique to the supplier and it shows the ratings for each of the metrics for the current review period as well as four prior quarters. We display this in a color coded matrix so that it is easy to see where each metric is improving, staying the same, or regressing from period to period. For my employer these quarterly business reviews give us frequent touch points with our suppliers. This helps us to identify issues and areas for improvement to strengthen our supplier relationships and our business.

Throughout this article I have hit on several best practices with respect to supplier scorecards. I want to stress that this is just a tool. The fact that you have a scorecard system in place should not prevent you from acting immediately if issues present themselves. After all, this should be a collaborative exercise which will benefit both your company as well as your suppliers. In addition it is important to solicit internal feedback from interested parties. Supplier scorecards should be used to make decisions about whether or not to continue supplier relations or to pursue alternative suppliers.

Mike Cleary is a Software Quality Assurance Engineer at Empirix pursuing his Masters of Science in Management of Technology from the University of New Hampshire. He has over ten years of experience in testing IP and telephony solutions across a variety of platforms. In his current role he is responsible for not only ensuring Quality in the E-XMS solution but other administrative tasks such as lab configuration, VM server, and perforce administration.

by Jennifer Hart Yim | Jun 5, 2014 | Blog, Manufacturing & Distribution, Strategy, Supply Chain

This article is part of a series of articles written by MBA students and graduates from the University of New Hampshire Peter T. Paul College of Business and Economics.

By now we have all heard the story of GM’s faulty ignition switches that are being linked to thirteen deaths and thirty one front-end collisions. The ignition switches in car models: Chevy Cobalt; Chevy HHR; Pontiac G5; Pontiac Solstice; Saturn Ion; and Saturn Sky, lacked the torque specs required by GM engineers. Heavy key chains, bumpy roads, or an accidental knee hit were all reasons reported that could cause the ignition switch to rotate to the off or idle position. Once this happened, the driver would lose control and the air bags would fail to deploy if a front end collision occurred. A total of 2.6 million vehicles were recalled, of that 2.2 million were in the United States. For this type of recall, GM was not requiring vehicles to go back to the manufacturer or be disposed. Rather, a more robust key ignition was distributed to all authorized GM dealerships and customers were told to bring their cars to the local dealership and a new ignition switch would be put in for them.

Despite the massive recall and all the negative publicity that goes along with such an event, GM still posted positive numbers in their quarterly earnings. GM posted an operating income of $0.5 billion for 1Q14, which is included the $1.3 billion recall-related charge. Furthermore, GM controlled approximately 17% of the U.S. market share. After the ignition switch incidents started to gain traction, GM swore to reorganize their global engineering department, and they did. So, if GM’s sales profitability is surviving, their negative press contained, and their market share intact, what exactly went wrong?

Two-thirds of General Motors automotive costs in 2014 are from supplier sourced parts. However, this was not always the situation. Back in 1999, GM underwent an extensive effort to disassemble their vertical integration in hopes of reducing overall costs. At this time, Delphi Automotive was owned by GM, but separated during the same year. For decades, GM was Delphi’s only customer, and even when Delphi executives knew GM was going to make them a public company, they were only able to move 22% of their business to other customers. When GM officially made Delphi a public company, 82.3% of their shares went to GM shareholders. That means that only 17.7% of Delphi was sold to public investors. In order to survive as a company, Delphi had to start making cost reduction decisions. To do this, companies often lay off employees and make cheaper parts, Delphi was no different. Now during this same time period, GM executives were focused on focused on costs reductions and were driven by numbers, hence the selling off of Delphi. It should be noted that if a company sells off their single largest parts supplier, fully aware that the move may cause the supplier to go belly up, there will be some strained relationships. Delphi was now thrown into a position where they must compete with other parts suppliers for GM’s business. An important part of the deal GM made when selling off Delphi was to keep all current supplier contracts. In addition, GM gave Delphi the opportunity to match any competitor’s bid until 2002. The earliest model of a recalled GM car was 2003.

Strained supplier relationships are not ideal for business, but should not affect the quality of a product, such as an ignition switch. Let’s fast forward to 2008. Delphi had declared bankruptcy three years prior and GM was beginning to pull them out of their financial burden. A contract was found between GM and Delphi that was drafted in 2008. The document is a little difficult to follow, but there are a few interesting lines in Section 5.09 Product Liability Claims. It appears that, GM said they would share the blame with Delphi for any claims against them. However, GM would not be held responsible if one of Delphi’s parts, or a part made for Delphi by a third party, fails. The contract continues on to say that GM would pay any legal fees if a claim was made against Delphi, but Delphi must defend GM through a potential lawsuit. This contract was drafted and signed in 2008, during which Delphi was bankrupt, so it appears they had little negotiating power.

This raises concerns specifically about the ignition switch specs. It came out that GM officials knew the ignition switch they purchased from Delphi was not up to their standards. After some more research, an email transaction between Delphi officials in regards to the plunger, the vital part that holds the key slot in place with a spring, and the ignition switch. At the end of the document, the original engineer drawings are attached. From the technical drawings it can be seen that Delphi did in fact outsource the design specs, and possibly the manufacturing, for the plunger design. Another document, that was preceding the email transaction, appears to inform GM that the plunger part was changed and the responsibility of the supplier is “closed”. This could have been a legal move meant to save Delphi if any claims were made related to these parts.

After all of this evidence, where does the blame lie? It would appear that GM used their powers to force Delphi into a contract that held them responsible for any claims against their products. While Delphi did warn GM that the torque requirement for their ignition switch did not meet GM’s requirement, it is unclear whether or not a verbal warning will play into the legal battle. This case is currently ongoing, and it will be interesting to see how it plays out.

Connor Harrison holds a B.S.M.E and MBA from the University of New Hampshire.