by Fronetics | Oct 5, 2015 | Blog, Logistics, Strategy, Supply Chain, Transportation & Trucking

On October 1st the 735-foot cargo ship El Faro issued a distress call, and then vanished in the eye of Hurricane Joaquin. The search for the ship, captain, and crew has thrust the shipping industry into the spotlight.

There is a common misconception that the majority of goods we purchase arrive via plane, or are transported via road. The reality is that 90% of everything we buy comes by ship – and it’s not likely that this number is going to decrease any time soon.

The advent of the megaship

In the last 50 years cargo-carrying capacity has increased by 1,200%. In the past 10 years cargo-carrying capacity has increased by 80%. Today’s bohemyths including the CSCL Globe, MSC Oscar, and MSC Zoe will soon be surpassed by ships that can carry more, and more. In June the major Chinese shipping group Cosco announced that it has ordered nine 20,000-TEU capacity ships, with an option for four additional identical vessels.

Larger ships are about efficiency and about narrowing the cost advantage. Not only do larger ships carry more containers, they also consume as little as 50% of the fuel per container moved as older ships, while also more than halving insurance and staffing costs.

The race for efficiency and cost advantage is competitive. The Globe held the record for largest carrying capacity for just 53 days, and then had to relinquish the title to The Oscar. The Oscar has a capacity of 19,224 TEUs, 124 more TEUs than The Globe.

Congestion

The increase in the size and volume of ships is putting pressure on ports. At least 7 out of the 10 busiest US ports by container volume are grappling with regular congestion. Early this year, congestion crippled West Coast ports grinding activities to a halt. Although operations have resumed, it won’t be smooth sailing going forward. It is projected that congestion will only get worse as ships continue to grow in size and volume. A 2013 Department of Transportation study projects that between 2010 and 2040 the volume of the US’s container trade with Northeast Asia—which accounts for the majority of the US’s overall container trade— will more than triple.

In a recent Wall Street Journal article, Frank Layo, retail strategist at consulting firm Kurt Salmon, points to the economic costs of the congestion. He forecasts that the cumulative costs of shipping delays could reach $7 billion this year and climb as high as $37 billion in 2016. Additionally, he expects some retailers to divert shipments from Asia to more-expensive routes to avoid congested West Coast ports. This could impact consumers in the form of stock-outs and price increases.

Loss

According to a recent survey by the World Shipping Council, an average of 1,679 containers are lost overboard every year. The loss of these containers cause significant economic losses for carriers and their customers, have the potential for harming the environment and marine life, and are a hazard to those on the water (floating containers pose an off-shore danger).

The majority of time ships don’t lose their entire load overboard. Rather, a number of containers are lost. But what happens when an entire load is lost, or even worse, when an entire ship is lost?

AGCS experts believe that the industry should prepare for a loss of $1 billon or more in the future. Captain Rahul Khanna, Global Head of Marine Risk Consulting, AGCS, believes that a $2 billion container ship loss scenario is not out of the realm of possibility.

El Faro is not a megaship. Nonetheless, El Faro and her crew of 33 play a significant role in the global economy. As Hurricane Joaquin moves out of the Bahamas we can hope that El Faro, her captain, crew, and cargo will be found – safe.

by Fronetics | Sep 30, 2015 | Blog, Marketing, Social Media, Strategy, Supply Chain

The social economy is estimated to be $1.3 trillion U.S. dollars annually. Social media is more than a collection of personal commentary, photos, and inspirational quotes. Increasingly, social media creates an opportunity to gather information, and social media is becoming a useful tool for businesses to connect with other businesses and clients. Although Facebook is notorious for gathering information, social media companies are not the only companies who can gather intelligence.

Data Gathering

Gathering of intelligence has never been easier. Although there are still traditional indicators of sales and traditional feedback loops, the age of social media allows for swift collection of intelligence. According to McKinsey, “Analysts typically spend 80 percent of their time gathering information before they begin to analyze it. Social intelligence radically alters this process. Numerous tools allow analysts to create dynamic maps that pinpoint where information and expertise reside and to track new data in real time.”

Capturing the Consumer

Collecting information from your consumers online— the good, the bad, and the dirty— can help you understand consumer sentiment around brands. By searching for key words or terms you may improve sales strategies, product placement, or understand demand cycles.

Do you want to see what clients and consumers say about you and your products, about their reliance, frustration, appreciate of your role in the supply chain? You should! But you can also have a look at what is trending, what your competitors are doing, and how you can gain traction through social media. The window is a unique opportunity for you. If your competitors are garnering more views, figure out why. Do they highlight their employees? Do they link directly to items for purchase? Do they use keywords you’re not using? Are they presenting themselves as leaders in the industry by blogging?

Storm Surge

Storms happen, and they’re stronger than ever. Natural disasters will never cease. Accidents happen. There’s no fix-all, no cure for these things, but there are new ways to manage these challenging moments when they strike. In March 2012, the Red Cross announced the creation of a social media crisis monitoring center called the American Red Cross Digital Operations Center.

When Hurricane Sandy hit the Eastern Seaboard, the Red Cross was able to see how valuable social intelligence can be. According to an article in Fast Company, How the Red Cross Used Tweets to Save Lives During Hurricane Sandy, “During the week of Hurricane Sandy, the Red Cross tracked more than 2 million posts and responded to thousands of people. In the end, 88 social media posts directly affected response efforts—a fairly significant shift of resources.”

While people lost power during Hurricane Sandy, many still had internet access on their phones. They could access news updates, connect with loved ones, and ask for help through social media. According to the Pew Research Center’s Project for Excellence in Journalism, more than 20 million tweets were sent about Hurricane Sandy in the span of 6 days.

The intelligent thing to do for your company just might be to explore social media intelligence.

by Elizabeth Hines | Sep 29, 2015 | Blog, Strategy, Supply Chain

Across the globe, many industries are seeing aftermarket services outperforming the general market. We can point to many reasons for this occurrence: the tendency for aftermarket services to remain stable in trying times, buyers remaining flush with cash, competition among buyers driving valuations higher with historically low pricing, and buyers making strategic purchases to focus on supplementing growth of their own businesses by acquisition. Regardless of the reason why, investors have become increasingly interested in the aftermarket sector and the implications of this are significant. These deals have the power to change the market, alter customer base, and challenge companies’ competitive positions.

This is a far different story from just four years ago when an article ran in the New York Times Dealbook section by Stephen Davidoff titled, “For Private Equity, Fewer Deals in Leaner Times.” Davidoff’s article listed the primary forces that drove turbulence in that marketplace. At that time, there were too few “good” merger and acquisition opportunities, “deals” were greatly overpriced, and there were fewer sellers in the market (and the ones that were making themselves available are being snatched up by strategic buyers). But what was most interesting, and what I’ve been tracking since then, was that the private equity industry’s biggest problem was having too much money to invest. You read that correctly — too much money to invest.

When I read the phrase “too much money to invest,” it got me thinking about the hi-tech aftermarket services industry and how underserved it had been from a private equity standpoint. In the hi-tech aftermarket industry in particular, there were, and still are, plenty of really good platform companies with strong footholds in service or geographic niches that truly make them unique and valuable. What they typically lack, though, are the funds and guidance that a responsible and possibly patient private equity firm can offer. Not only do these platform companies in the high-tech aftermarket services space make for attractive investments, but it seems to me that the financials in these “niche companies” are there to support private equity interest, as well. These businesses typically have gross margins in the 35-40 percent range and net margins that are really attractive when compared with the overall hi-tech space. Combining or rolling up companies with expertise in adjacent service and/or geographic areas into a “newco” with broader reach and a deeper service offering will surely deliver financial results that private equity would consider better than not investing. The high-tech aftermarket services space is a fractionalized marketplace with accomplished participants, quality customers, and better than traditional financials when compared with the overall industry averages. And private equity firms have started to realize these points. To this, I say bravo, but there’s still lots of money that needs to be put to work.

![5 Tips Supply Chain Managers Need to Build Landing Pages That Convert [Infographic]](https://fronetics.com/wp-content/uploads/2024/10/landing-pages-that-convert.jpg)

by Fronetics | Sep 28, 2015 | Blog, Logistics, Marketing, Supply Chain, Talent

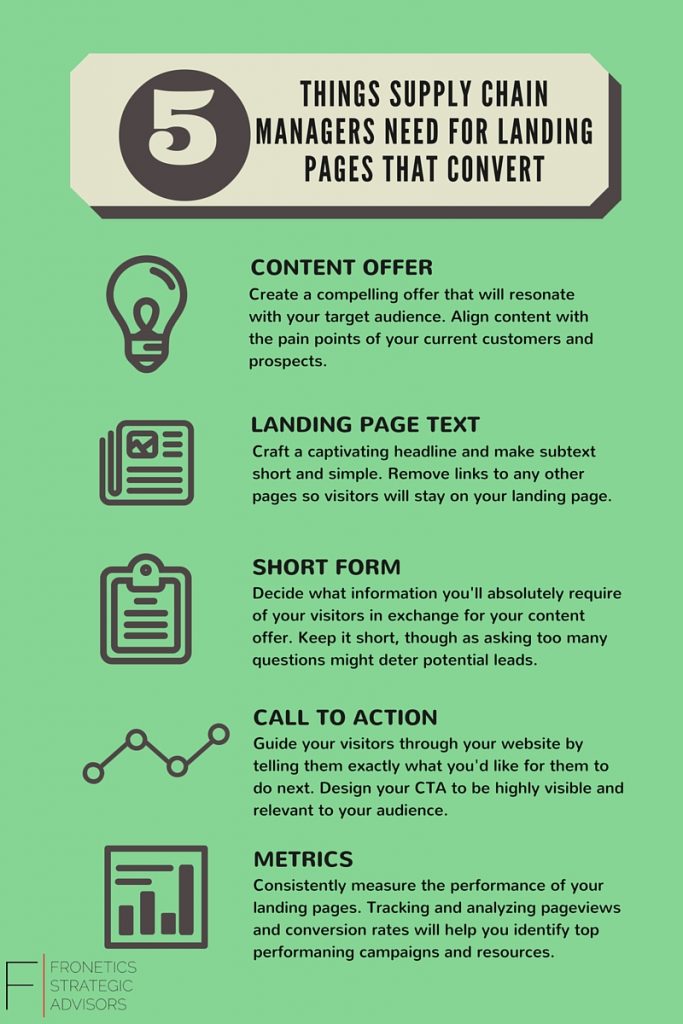

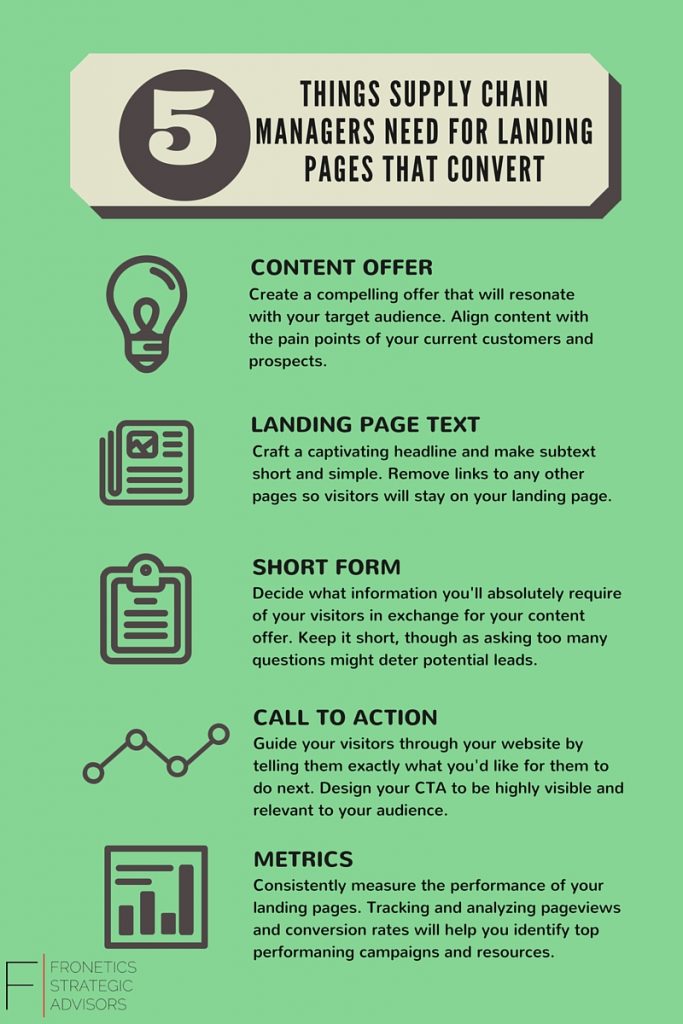

Landing pages are a fundamental tool in converting website visitors into leads. They’re what convince your visitors that they absolutely must download your fabulous resource offer. Yet often times they’re treated as the annoying little sibling to high-value content pieces – tagging along almost as if an after-thought. In reality, landing pages have just as much, and possibly even more importance than the content offer. Besides, what good is your best resource if it’s landing page stinks?

Here are five tips supply chain managers need to build landing pages that are sure to convert visitors into leads.

by Fronetics | Sep 23, 2015 | Blog, Logistics, Strategy, Supply Chain

Logistics is logistics is logistics– right? Wrong. The direction the product is moving in the supply chain – forward or backward – makes a difference.

Forward logistics, or the forward supply chain, is all about getting the product to market. In contrast, reverse logistics, or the aftermarket supply chain, is inclusive of events that move the product at least one step back in the supply chain. That is, reverse logistics is inclusive of activities that move goods from the consumer to the distributor or the manufacturer, and is inclusive of operations related to the reuse of products and materials.

The direction in which the product is moving matters. Companies that attempt to employ the same strategy for their reverse logistics process as they do for their forward logistics process do so at their peril.

The forward supply chain has its challenges. The forward supply chain has risks and it has surprises. However, the forward supply chain is more predictable and more certain than the aftermarket supply chain.

There is a greater level of uncertainty and predictability in reverse logistics. Because of this, when it comes to reverse logistics, flexibility needs to be a key component of your strategy.

Specifically, in forward logistics the product itself, the quality of the product, and the volume of the product are known and are relatively easy to forecast. Likewise, rules and regulations are fairly straightforward and uniform, and the value of the product is known.

When it comes to reverse logistics there are many unknowns. The product, the volume of the product, the quality of the product, and the value of the product are difficult to forecast. Rules, regulations, and restrictions are constantly evolving and vary by state, country and region. Moreover, the visibility and speed at which it is necessary for the aftermarket supply chain to move is vastly different than that of the forward supply chain.

It is important to remember that when it comes to the supply chain one size does not fit all. Incorporating flexibility into your aftermarket supply chain strategy is essential to your success.

This post originally appeared on Electronics Purchasing Strategies.

by Fronetics | Sep 22, 2015 | Blog, Logistics, Strategy, Supply Chain

The perception of the reverse logistics industry has shifted over the last several years. Reverse logistics has gone from being viewed as an afterthought to a necessary evil to being recognized as a wealth of opportunity. This shift has occurred as a result of several factors including: shortened product lifecycles, increased regulations and standards, consumer demand for corporate responsibility, and an increase in razor-thin margins. Equally important in the industry’s makeover – companies have come to understand and to realize the benefits of reverse logistics such as a reduction in costs, a revenue stream, and as a way to enhance customer loyalty.

Unfortunately when choosing a solutions provider, many companies fall prey to the assumption that a certain level of compliance and data security are givens. More often than not; however, the reality is that the service provider does not offer the level of compliance or data security assumed by the customer – and more often than not, the level that is offered by the service provider is inadequate. When due diligence is left to assumptions companies pay dearly.

Specifically, faulty assumptions regarding certain levels of compliance and data security provided via a service provider leave the customer open to lawsuits and fines as a result of non-compliance and leave the door open for data leakage and theft. The financial costs associated can be astronomical. Moreover, the company and the brand can take a significant hit resulting in a decline or even loss of customers and customer loyalty. In short, choosing a reverse logistics service provider that does not offer the compliance and data security necessary for your company can negate any gains realized as a result of your company’s reverse logistics strategy.

When selecting a reverse logistics service provider don’t make assumptions; don’t take the route of complacency. Instead, ask questions, conduct due diligence, and make sure that the level of service provided goes beyond meeting your needs – the service provider should be able to exceed your company’s needs.

When selecting a reverse logistics service provider, look for a provider who has network and standards in place which ensure global success. What does this look like? Arrow Value Recovery is the gold standard. Arrow provides uniform standards and quality controls. Unlike some service providers who default to the lowest common denominator, Arrow providers customers with consistent levels of service –globally. Moreover, Arrow ensures that every step of the recovery, data sanitization, and reuse and recycling process is not only transparent but is also 100 percent auditable.

Taking the time to thoroughly vet a reverse logistics service provider is essential. Don’t make assumptions and don’t default to complacency. Did you know that an estimated 70 percent of data breaches come from computers that are offline – typically computers that have been disposed of by the equipment owner? Don’t assume that your reverse logistics provider is offering your company the level of compliance and data security necessary – verify the facts.

This post was originally published on Electronics Purchasing Strategies.

![5 Tips Supply Chain Managers Need to Build Landing Pages That Convert [Infographic]](https://fronetics.com/wp-content/uploads/2024/10/landing-pages-that-convert.jpg)