by Fronetics | Nov 1, 2017 | Blog, Manufacturing & Distribution, Strategy, Supply Chain

Manufacturing companies are hoping to continue their revenue growth in 2018 by focusing on 3 key areas.

KLR has released the results of its annual manufacturing industry outlook report, and the optimism following last year’s elections will continue straight through 2017.

With promises of tax reform, decreased federal regulations and looser trade agreements, manufacturers have slowly seen revenue growth throughout the U.S. markets. That growth is projected to continue into 2018.

56% of respondents expect business will continue to increase throughout the year.

And though manufacturing companies are striving to control their costs and cut back on unnecessary expenses, many companies reported increasing their marketing budgets, including technology, to invest in the future of their revenue growth.

So where is the additional money going? Manufacturing companies are investing their profits back into new products, expanding markets and breaking into new territories.

Here are the top 3 priorities for manufacturing companies in 2018.

1. Increasing share in existing markets

Over the next 12 to 18 months, 64% of the manufacturers surveyed expect their growth to come mainly from increased market share and organic growth in existing domestic markets. Manufacturing companies are looking to increase their market share through innovation, strengthening customer relationships, reliable hiring practices, and staying ahead of their competitors.

2. Seeking new markets for products and services

Manufacturing companies are trying to think outside of the box when it comes to expanding their markets. Avon got its big break when it took the now-dated approach of selling products door to door. By trying a different avenue, it was able to increase revenue without fighting for retail space with other corporate giants. Like Avon, companies are working hard to come up with innovative ways to break into untapped markets.

3. Developing new products and services in response to changing consumption patterns

Using social media platforms and other marketing tools, it’s easy for manufacturing companies to stay in touch with their customers. This engagement provides the best insight into the types of products, features and solutions your customers are looking for. Based on this crowdsourcing, or social listening, companies are able to develop products that they know will resonate with consumers and their changing needs. Though product development can be expensive and risky, incorporating customers into the conversation helps manufacturing companies minimize risk.

Despite growth throughout 2017, there are still challenges that manufacturing companies face. How are manufacturers coping with these challenges? They are adjusting their priorities and focusing on these three areas to continue growing their business and, ultimately, their sales.

Related posts:

by Fronetics | Oct 24, 2017 | Blog, Current Events, Logistics, Strategy, Supply Chain

Cities should consider Amazon’s HQ2 search criteria as a roadmap for attracting innovative companies, empowering residents, and driving a healthy local economy.

We’re living through a seismic shift in the way business transactions are being conducted. E-commerce is now king. We might be tempted to think the decline of retail equates to business transactions being moved from physical space to a digital world. Will our cities and the shops that line their streets become obsolete in the face of e-commerce?

Amy Liu and Mark Muro of the Brooking Institute’s Metropolitan Policy Program contend that if Amazon’s recent search for a second headquarters (“HQ2”) has anything to show us, it’s that America’s cities still have an important role to play in the future of e-commerce.

How cities could change

Liu and Muro suggest cities take a close look at Amazon’s selection criteria for HQ2’s location and extrapolate the best ways to “build up the fundamental assets prized by innovative firms and industries.” In this way, cities can best “garner a bigger share of high-tech growth,” and furthermore, be a part of our nation’s gaining “a competitive foothold in the digital future.”

Liu and Muro draw four main takeaways from Amazon’s city selection criteria:

- Capacity to produce skilled, technical talent

- Access to domestic and global markets through modern infrastructure

- Connected and sustainable placemaking

- Culture and diversity

Cities that boast these characteristics will have the best chance at attracting the kind of companies that will shape the future of how we do business — e-commerce and beyond. These companies will employ and empower local talent. And not just highly skilled talent. I can’t help but think of this recent Wall Street Journal article about the impact that Amazon’s presence has had on Fall River, Massachusetts.

Such employment opportunities will attract new residents. New residents will boost the local economy. Strong local economies boost the health and well-being of the community. And the positive benefits snowball from there.

I’m speaking in generalizations here, but cities stand to gain quite a bit from considering Amazon’s HQ2 search criteria. Of course, there are plenty of negatives to making way for the Amazons of the world — the decline of Main Street being one of them. But if the digital world plays an increasingly important role in the ways we conduct business and commerce, isn’t there value in strategizing around it?

Related posts:

by Fronetics | Oct 23, 2017 | Blog, Current Events, Supply Chain

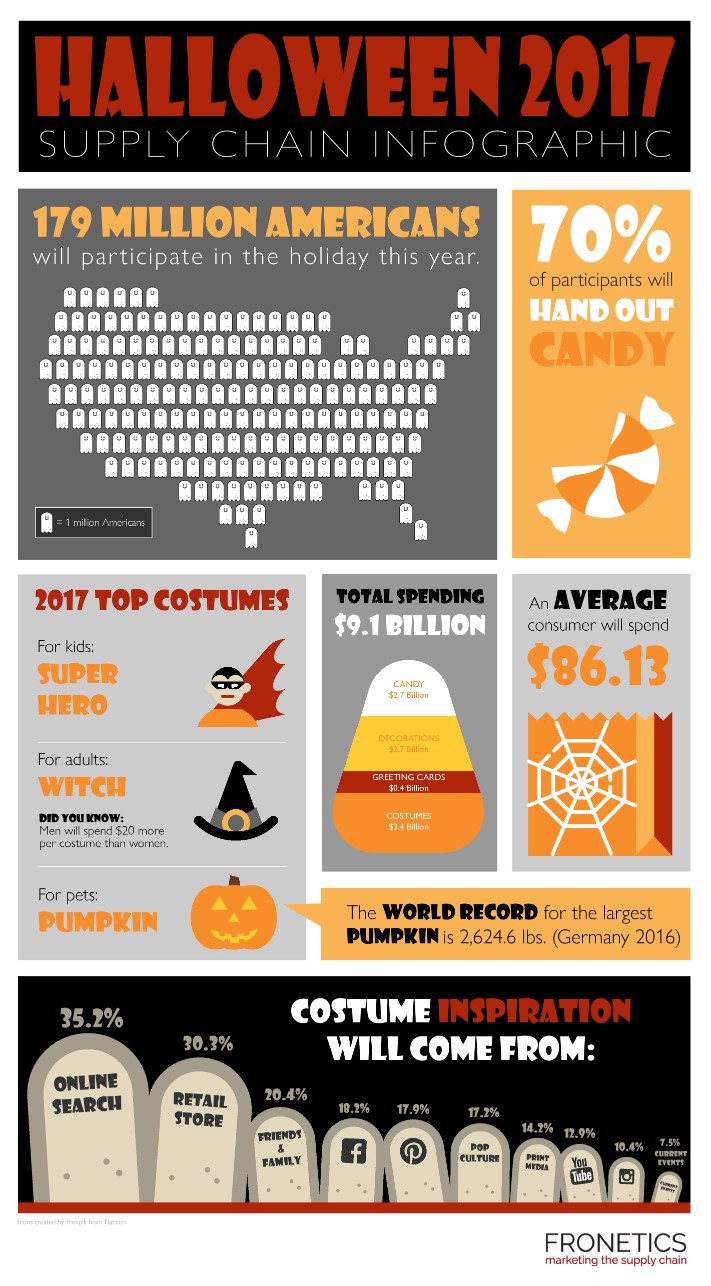

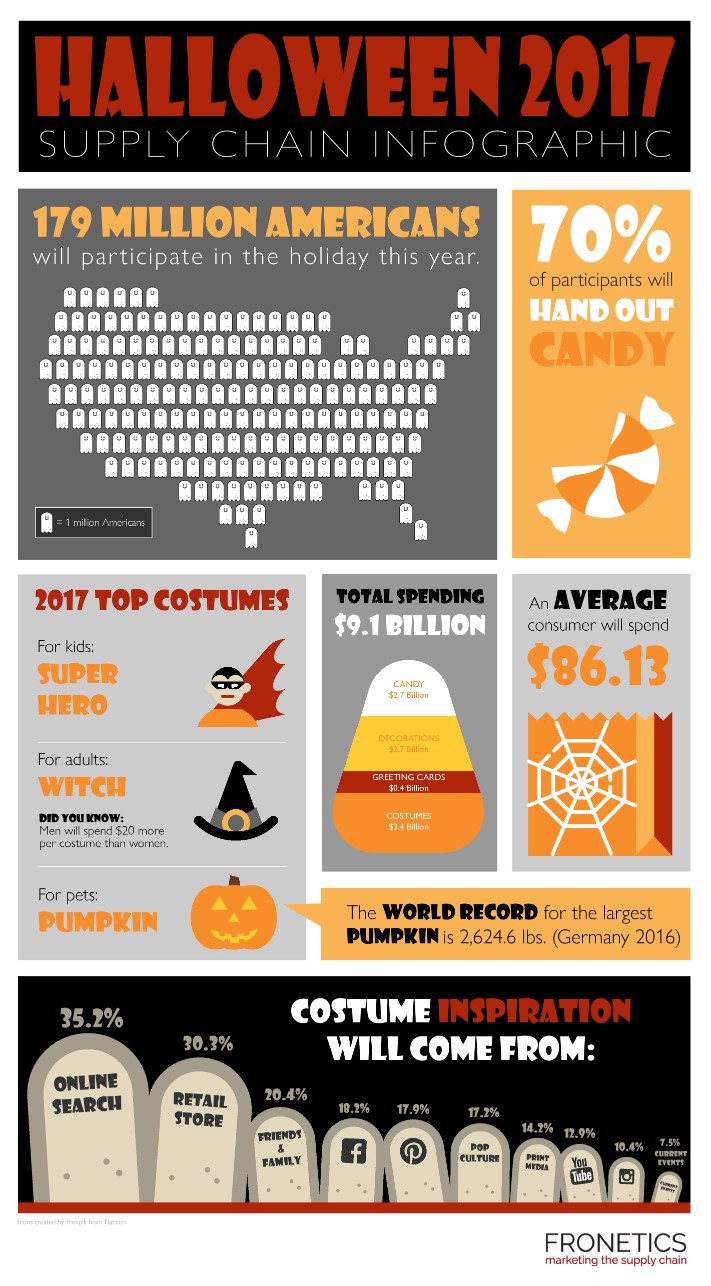

Consumers will spend a record $9.1 billion during Halloween 2017.

U.S. consumers will take to the retail markets Halloween 2017 and spend a whopping $9.1 billion on Halloween costumes, decorations, candy and more, making it the largest spending for the spooky holiday to date.

The National Retail Federation reports that consumers are preparing to be the baddest witches on the block, spending almost a billion more dollars this year on supplies than in 2016 ($8.4 billion). And the men are really stepping up their game, spending on average $20 more per costume than women.

“Americans are planning to spend more than ever as they gear up for Halloween,” NRF President and CEO Matthew Shay said. “Retailers are helping customers celebrate in style with a huge selection of costumes, candy and decorations to cater to ghosts and goblins of all ages.”

From 2017 blockbuster hits like Wonder Woman and Spiderman, it’s no wonder the most popular costumes for kids are superheroes. And let’s not forget about Fido — the most popular costume for pets for Halloween 2017 is a pumpkin.

Still need inspiration for the boo bash you’re attending? Try heading over to Instagram, a source of inspiration growing 12% year-over-year. Other consumers will get ideas from online search (35.2%), a retail store (30.3%), Facebook (18.2%), Pinterest (17.9%), and pop culture (17.2%).

Need more fun facts about Halloween to get you into the scary spirit? Check out this year’s infographic from the NRF’s survey.

Halloween 2017 supply chain infographic

(Made with Canva)

Have a safe and happy Halloween 2017, everyone!

Related posts:

by Jennifer Hart Yim | Oct 12, 2017 | Blog, Data/Analytics, Logistics, Strategy, Supply Chain

Shippers should be tracking these last-mile metrics to drive down the high cost of last-mile logistics.

This post comes to us from Adam Robinson of Cerasis, a top freight logistics company and truckload freight broker.

Using technology to improve last-mile metrics is essential to driving last-mile costs down, but how do shippers know if the technology is helping or hurting? The answer to this question lies in using last-mile metrics to track key performance indicators and target levels of service to ensure accountability, visibility and continued reduction of costs in last-mile delivery.

A recent survey of customer service experiences, reports DC Velocity, revealed many retailers feel current technologies do not address their customer service needs, and as few as 3 percent of retailers cite full support as part of their current systems. Unfortunately, history teaches shippers that reducing costs means cutting customer service, but integrating customer service data into delivery operations and transportation systems is key to increasing a brand’s value. In fact, 72 percent of survey respondents believe it is very important to improve access to data for in-transit shipments, which includes last-mile delivery. Essentially, shippers need to track these 11 metrics.

1. On-Time Deliveries Are King of Last-Mile Metrics

The number of on-time felt or late deliveries are more important than any other metric tracked in last-mile logistics. These metrics provide a quick yes or no analysis of the effectiveness of your last-mile logistics strategy.

2. Fuel Consumption Rates

Last-mile metrics involving fuel consumption rates can vary and depend on the preference of the company, but how fuel consumption rates are calculated can greatly influence whether a driver is saving or wasting fuel.

For example, overall fuel consumption costs may be lower, but interval-based fuel consumption rates could show consistent, stopping and starting patterns that do not coincide with existing routes and drive up fuel costs. As a result, fuel consumption rates should be calculated by averaging the total fuel costs per driver, all drivers, per delivery vehicle and per route.

3. Last-Mile Vehicle Capacity Used Versus Available

Last-mile logistics should also consider the capacity utilized against the available capacity in all last-mile delivery vans. This metric is calculated by dividing the available capacity by the total capacity. Excess available capacity rates allude to poor loading procedures or the need to consolidate routes. The same calculation is used to calculate capacity used, dividing the capacity used by total capacity.

4. Planned Versus Actual Mileage

Planned versus actual mileage last-mile metrics are calculated by dividing the actual mileage per vehicle, driver, or route by its own planned mileage. Higher actual mileage rates reveal problems with route planning or unforeseen detours to route schedules.

5. Driver Hours In-Motion and Stationary

In-motion and stationary driving hours are expenses in last-mile logistics, and, unless your company employs a fully autonomous and drone-assisted delivery network, stops are necessary. However, the amount of stops and hours of both in-motion and stationary position can help measure performance of drivers. Excess stationary hours or excess in-motion hours are calculated by dividing the total amount of time drivers spend on a route by the number of hours in motion and the number of hours stationary.

6. Cost Per Item, Per Mile, and Per Vehicle

Last-mile metrics should track the cost per item, per mile, and vehicle associated with a specific route and the company as a whole. As a result, shippers should average the total costs per item for a given route and for the company’s shipments over a set period. The same average process should apply to both mile and per vehicle metrics, too.

7. Number of Stops

Last-mile logistics and metrics should also track the number of stops per vehicle. This is important to monitoring fuel costs, but it can also allude to poor route optimization practices. In other words, vehicles with a high number of stops should be reevaluated for ways to improve route schedules.

8. Average Service Time

The average service time metric can be complicated because it involves different data to calculate, depending on the source of an order. Most commonly, it is calculated by dividing the total service time at the store by the total number of deliveries. In other words, what is the average amount of time spent per order between the store, the warehouse, and other pre-shipping processes?

9. Customer Complaints

The need to manage customer service and address customer complaints leads to another metric in last-mile logistics, reports Talking Points With Adrian Gonzalez. What is the total number of customer complaints, and how do they stack up against the total number of deliveries? This metric is calculated by dividing the total number of deliveries by the total number of complaints received.

10. Order Accuracy

Order accuracy is calculated by comparing the known inaccuracies of orders against all shipped orders. Since some consumers may never report inaccurate orders, it is difficult to track a specific order inaccuracy metric. Instead, shippers should track order accuracy rates by dividing the total number of shipped orders by the number of orders not subject to customer service disputes, calls or complaints.

11. Damage Claims

A final last-mile metric to track is also about problems with orders: damage claims. Shippers should track the number of incoming damage claims against the total number of shipments. This is calculated by dividing the number of damaged claims by the total number of shipments. The resulting value is the percentage of damage claims in decimal form.

Using Metrics, Shippers Can Improve Last-Mile Logistics

Metrics allow shippers to understand the ins and outs of last-mile logistics, and metrics provide a means of measuring the performance of last-mile logistics plans against actual processes and their associated costs. As a result, shippers can make changes to their operations to improve last-mile services through last-mile metrics, and knowing more about last-mile needs is key to providing more than just the standard last-mile delivery options.

Related posts:

by Elizabeth Hines | Oct 10, 2017 | Blog, Consumer Electronics, Current Events, Manufacturing & Distribution, Strategy, Supply Chain

Of legal obligation, financial incentives, and convenience, what best drives consumers to practice proper e-waste recycling?

The United States is a nation of consumers, and there are few things we enjoy more than our electronic gadgets. Unfortunately, for every new device — or upgrade — introduced to the market, there’s an older model that becomes obsolete.

The world produced 41.8 million metric tons of e-waste in 2014, according to a study published by the United Nations University. So how can we combat this growing problem?

The recycling option… and sometimes law

Recycling products that we’re no longer using is always good practice. It can help protect the environment from hazards that are in our electronics and batteries. And many times, the device can be refurbished and donated to a person in need.

Sometimes just asking people to recycle isn’t enough, though. Some governments have made it illegal not to recycle. For example, the EU has gone so far as to institute the Battery Directive. Understanding that batteries commonly contain elements such as mercury, cadmium, and lead, the EU has set an objective of improving environmental performances of batteries, and setting a standard for their waste management as well.

In the United States, cities like New York City have made it illegal to simply throw out electronic devices. Instead, residents need to bring their devices to a recycling center, many of them conveniently located at other electronic retail outlets.

Incentives

If less hazardous waste in landfills, a cleaner environment, and compliance with laws and regulations aren’t enough, how about saving money as an incentive to recycle e-waste?

Many manufacturers and retailers offer discounts on purchases with the return of old devices. Best Buy, for example, has experimented with trade-in and recycling programs that offer gift cards or cash for customers who bring in old devices. As programs like this can leave the retailer struggling to break even, they often aren’t financially attractive enough to be the sole incentive drawing consumers to recycle e-waste.

But one incentive that is very effective is also, probably, the most obvious — convenience. One survey found that 43% of respondents would be more likely to recycle e-waste were cell phone and battery recycling part of curb-side pickup.

The convenience of curb-side pickup for paper, plastic, and aluminum helped to make recycling ubiquitous in neighborhoods across the country. It’s the same thought process that leads researchers to believe that the convenience of a curb-side pickup will encourage more individuals to recycle their electronic devices and batteries.

This post originally appeared on EBN Online.

Related posts:

by Fronetics | Sep 28, 2017 | Blog, Current Events, Strategy, Supply Chain

Terrorism is a reality that, unfortunately, requires our growing attention in the supply chain world.

The British Standards Institution Supply Chain Services and Solutions publishes an annual report that analyzes global trouble spots for supply chain operations. This year’s report focused on the continual rise in terrorist attacks and how it will continue to affect the supply chain.

In 2016, there were 346 attacks in just one year — that’s an 8.5% rise on the previous year, averaging 6.7 attacks every week.

Terrorism, in its broadest sense, describes the use of intentionally indiscriminate violence as a means to create terror or fear to achieve a political, religious, or ideological aim. This violence can take on many forms, including cyberterrorism, and can have dire consequences to the supply chain.

“The direct impact from acts of terrorism and the indirect effects from terrorist organizations’ exploitation of the supply chain have been, and will continue to be, critically felt across Europe,” said David Fairnie, principal consultant in supply chain security at BSI.

In 2016, supply chain terrorism attacks were more widely distributed than in any previous year, with 38% more countries suffering attacks. The top 10 countries for supply-chain-terrorism incidents accounted for $664 billion worth of global exports. That includes $96 billion of exports to the United States. Clearly, a significant volume of international trade is at risk for disruption by terrorist groups.

I recently spoke with Randy Russell of the Russell Group, an agricultural lobbying firm that works with farmers and manufacturers from the supply chain, to ask about his thoughts on terrorism and the impact it can have on the supply chain, especially related to our food and water supplies.

“Terrorism is a global problem that strikes locally. The net result of the horrible tragedy of 9/11 was a wake-up call to all Americans about the threat of terrorists groups. We have invested billions in intelligence and homeland security to ensure that a large-scale attack doesn’t affect two major areas in the U.S., our water supply and an outbreak amongst our food supply, especially our cattle industry.

“No country is completely safe, but we are exponentially better prepared to stop such attempts because of a well-coordinated effort. Remember at the heart of of terrorism is the hatred of democracy and the freedoms it is built upon. Their whole approach is to create fear and doubt within the boundaries of those who embrace freedom.”

We know the nation is doing its part to keep us safe, but how are we keeping our businesses and brands safe as well? The need for brand safety has never been higher. Sarah Golding, president of IPA and chief executive at CHI & Partners, called for the industry to do more to protective itself, stating that an estimated 20% of the $32 billion spent on digital video and display advertising is fraudulently billed.

So How Can You Prepare Your Supply Chain for terrorism?

Munters Lean Manager Marcelo Simiao weighed in on how he believes businesses can prepare themselves in the event of an attack:

“From the point of view of the supply chain, the consequences of a terrorist act on places such as airports, ports, and railroads are not much different from the ones caused by natural disasters. Therefore the preparations should be similar.

“The difference is that some of these areas don’t have contingency or emergency plans for natural disasters because risk varies according to regions. So, these areas should make a thorough risk analysis similar to other areas’ natural disaster plans, and also put it in place in the case of terror threats.

“Corporations should include in their risk analysis not only areas subject to natural disasters, but also the ones with high risk of terror attacks. They must include actions such as diverse footprint, secondary suppliers for the same components, emergency changes on factories set up. These actions are used to compensate losses/disruption of the supply chain flow.

“Furthermore, real-time data acquisition, big-data analysis, and effective planning are the key to fast reaction times for corporations once an attack/disaster happens. The sooner the corporation takes action in order to mitigate disruption, the less its flow will be affected. If an airport is closed, it is important to be the first one to know and the first one trying to move the cargo through alternate routes/intermodal.”

Related posts: