by Fronetics | Sep 8, 2015 | Blog, Data/Analytics, Marketing

The profile of marketing has definitely been raised lately. With a full 63% of businesses planning to increase their marketing budgets this year, its clear business leaders are looking directly to their marketing departments to drive growth. Along with expanding budgets and more pressure to produce results, marketing metrics are being more heavily scrutinized by executives; marketing departments are being asked to prove the worth of the increased investment in their marketing efforts. And with an enormous amount of potential data to track, marketing can seem more like big data. The good news is it doesn’t have to. Successfully presenting the value of your marketing efforts means showing your boss the metrics that will resonate and prove that you’re moving the needle where it really counts.

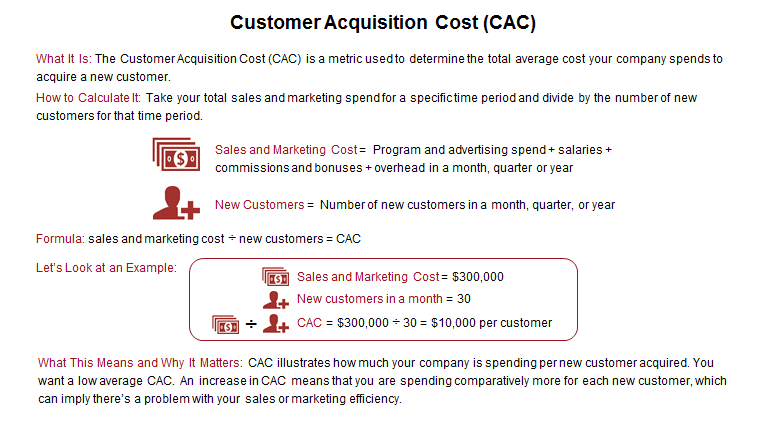

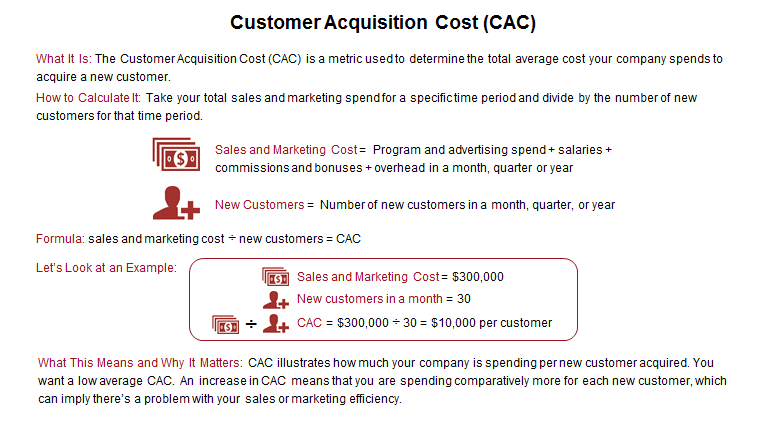

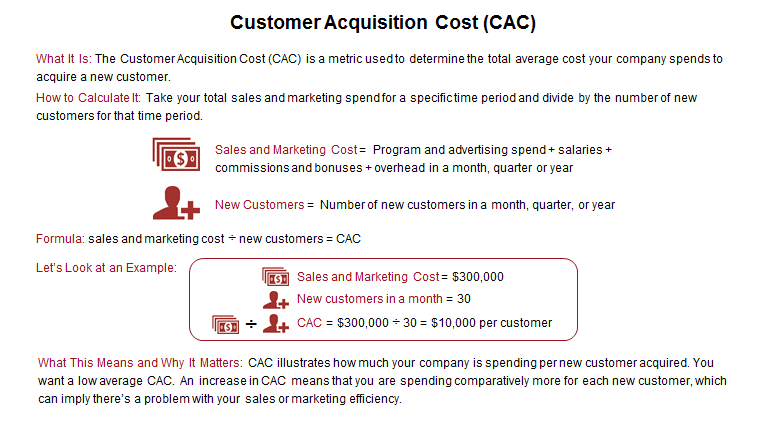

Do you know which metrics actually matter to your boss? Rather than talking about per-post Facebook engagement and other “soft” metrics, can you tell your boss, for example, if your company is spending more money this year to acquire new customers than it did last year? Let’s take a look at how you can calculate your company’s Customer Acquisition Cost (CAC) and why your boss actually does care about it.

Reporting on measurements that link your marketing efforts to the company’s bottom line, such as Customer Acquisition Cost (CAC), will put your marketing team in a much better position to make the case for executive support of current and future budgets and strategies. For more metrics that matter, download our guide to The Six Marketing Metrics That Your Boss Actually Cares About. Our 10-page guide lays out the six marketing metrics that will prove the value of your marketing efforts, along with formulas and examples to help you calculate your own metrics and explanations of why your boss finds these metrics so important.

by Fronetics | Sep 3, 2015 | Big Data, Blog, Data/Analytics, Logistics, Strategy, Supply Chain

Big data is, well, big. The term has gotten lots of buzz the past few years. But it’s big in other ways as well. According to McKinsey big data is defined as “datasets whose size is beyond the ability of typical database software tools to capture, store, manage, and analyze.” A 2014 Forbes article has 11 other helpful definitions.

With current technologies, there are increasing amounts of information to be gathered and exchanged in the world, creating more opportunities for businesses to harness that information and chart a course or tweak processes based on that information. According to an Accenture study, “97% of executives report having an understanding of how Big Data analytics can benefit their supply chain, but only 17% said that they have implemented it in at least one supply chain function.”

In a Boston Consulting Group article, Making Big Data Work: Supply Chain Management, the authors suggest three high-potential opportunities for supply chain management to take advantage of big data. Their suggestions help parse through the complicated, overwhelming network of big data. As they suggest, “with so much available data and so many improvable processes, it can be challenging for executives to determine where they should focus their limited time and resources.” Let’s have a look at the authors’ ideas, as gathered through research, on how to “increase asset uptime and expand throughout, engage in preventive maintenance of production assets and installed products, and conduct near real-time supply planning using dynamic data feeds from production sensors and the Internet of Things.”

Visualizing Delivery Routes

Big data, in the form of geoanalytics, can be used to better manage supply chain routes and help reduce transportation costs by 15-20%, especially when other partner companies are trying to coordinate deliveries. “The companies learned that they shared similar patterns of demand. Vehicle-routing software also enabled rapid scenario testing of dozens of route iterations and the development of individual routes for each truck. Scenario testing helped the companies discover as much as three hours of unused delivery capacity on typical routes after drivers had covered their assigned miles.” Real-time data from live traffic feeds, combined with past data helped to create new forecasts and eliminate wasted time.

Pinpointing Future Demand

In today’s volatile marketplace, relying on sales predictions can be risky and inaccurate, at best, a disaster at worst. According to the BCG article, advanced languages can now work together to create a most accurate forecast, freeing up sales people and their precious time to combat other issues and convert leads. “Advanced analytical techniques can be used to integrate data from a number of systems that speak different languages—for example, enterprise resource planning, pricing, and competitive-intelligence systems—to allow managers a view of things they couldn’t see in the past.”

Simplifying Distribution Networks

The European consumer goods company profiled in the BCG article, used advanced analytics to downsize from 80 factories across 10 countries, down to 20 factories. The distribution network shrunk, and efficiency and savings increased, the latter by 8%. Working with big data can help examine a diverse amount of information never before analyzed. Taking complex data and knowing how to handle the data can turn complexity into simplicity.

Marcelo Simiao, Lean Manager— Operations at Munters, seems to concur with the findings, and believes big data can make sweeping changes.

“Companies are struggling with today’s greater demand volatility. The Order-to-Delivery processes have been the focus of many improvement projects and lean initiatives that aim to reduce costs and improve response times. But most of today’s organizations have their supply chain functions fragmented into several different departments, creating process improvement projects that have results limited to the data they have at hand. This approach often doesn’t deliver value to the end customer. Big Data is changing this scenario by integrating the voice of the customer, sales and the entire supply chain. This integration and thorough data analysis allows organizations to align all of their focus on key projects that are not limited by functions, will improve customer satisfaction, and deliver results directly into the company’s bottom line.”

by Elizabeth Hines | Sep 1, 2015 | Big Data, Blog, Data/Analytics, Strategy, Supply Chain

Many organizations that jumped on the big data bandwagon have struggled to turn their new, boundless collection of data into actionable business information. As consultant Rich Sherman of Athena IT Solutions puts it, today’s businesses are struggling with “the transformation of data into information that is comprehensive, consistent, correct and current.”

Many organizations that jumped on the big data bandwagon have struggled to turn their new, boundless collection of data into actionable business information. As consultant Rich Sherman of Athena IT Solutions puts it, today’s businesses are struggling with “the transformation of data into information that is comprehensive, consistent, correct and current.”

Enter data governance programs, and, consequently, the data steward. Technology cannot always extract the most useful data, but the data stewards can, meaning the success of the data governance program rests to a large degree on their shoulders. But data stewards can be viewed with suspicion by other employees and nothing can kill the spirit of hard work more than distrust or a feeling that management is snooping and ready to pounce at the sign of even the slightest misstep.

Some business users are under the impression data stewards have been tasked to play dual roles, championing the organization’s data governance program while also using their position to crack down on anyone stepping out of line. To some, the data steward is really a data cop who “police” rather than manage the organization’s critical data elements. They believe anyone can be caught in the net cast by the data stewards as they fish for out-of-compliance data and bring it into line with policy or regulatory obligations. This can create needless friction within the organization and threaten the effectiveness of data efforts altogether. We can’t ignore concerns caused by the growing presence of data stewards at many organizations; in fact, it makes it even more important to show why such concerns are generally unfounded.

While it is true data stewards are indeed tasked with ensuring compliance with the policies and processes of the data governance program, critics need to bear the end goal in mind – to turn massive amounts of data into a useable corporate asset. And data stewards themselves can actually play a role in the effort to help “to take the view of data governance from police action to harmonious collaboration,” as another expert, Anne Marie Smith of Alabama Yankee Systems, LLC, put it. It won’t hurt for the data stewards – or the data governance managers – to acknowledge some employees will initially question their intentions. However, by reaching out to each business unit and explaining how data governance works and why improved data management will benefit the organization, the distrust can dissipate. Similarly, if the data steward is recruited from within the organization, it will alleviate some concerns since business users are more likely to trust a familiar face.

The complexity of data governance comes with a host of pitfalls – fears of data cops shouldn’t be one of them. What’s been your experience with data stewards in the supply chain? Do they play an important role in your organization?

![Drowning in big data, parched for information [Infographic]](https://fronetics.com/wp-content/uploads/2024/10/big-data-2-1000x675.jpg)

by Fronetics | Aug 24, 2015 | Big Data, Blog, Data/Analytics, Strategy

Big data is big. Over the past two years alone more than 90% of the world’s data has been created. Each day more than 2.5 quintillion bytes of data are created. For those who are more numerically inclined that is more than 2,500,000,000,000,000,000 bytes per day.

Companies are spending big money to determine how they can harness the power of big data and drive actionable, practical, and profitable results. The International Data Corporation (IDC) recently forecasted that the Big Data technology and services market will grow at a 26.4% compound annual growth rate to $41.5 billion through 2018, or about six times the growth rate of the overall information technology market.

Weatherhead University Professor Gary King notes that: “There is a big data revolution, but it is not the quantity of data that is revolutionary. The big data revolution is that now we can do something with the data.” Herein lies the problem. Even as the quantity of big data being generated increases, and even as the money spent on big data increases, the majority of companies find themselves struggling to do something with the data. Companies are drowning in data while at the time being parched for information.

KPMG recently conducted a survey of 144 CFOs and CIOs with the objective of gaining a more concrete understanding of the opportunities and challenges that big data and analytics present. The survey found that 99% of respondents believe that data and analytics are at least somewhat important to their business strategies; 69% consider them to be crucially or very important. Despite the perceived value of big data, 85% of respondents reported that they don’t know to analyze and interpret the data they already have in hand (much less what to do with forthcoming data).

Moreover, 96% of survey respondents reported that the data being left on the table has untapped benefits. 56% of respondents believe the untapped benefits could be significant.

Research conducted by Andrew McAfee, co-director of the Initiative on the Digital Economy in the MIT Sloan School of Management, supports this belief. McAfee’s research found that “the more companies characterized themselves as data-driven, the better they performed on objective measures of financial and operational results.” Specifically, “companies in the top third of their industry in the use of data-driven decision making were, on average, 5% more productive and 6% more profitable than their competitors.”

Looking forward, companies that are able to effectively collect, analyze, and interpret data will gain a competitive advantage over those companies who are not able to do so.

by Elizabeth Hines | Aug 19, 2015 | Blog, Data/Analytics, Strategy

Understanding your financial metrics at a granular level is important in that it allows for a true understanding of what is happening, and what is not. It enables you to drill down and appreciate, for example, similarities, differences, and outliers. Being informed at a granular level enables better decision-making when it comes to determining how to increase profits. How often does one need to look at these metrics and how does one evaluate and react to numbers?

The frequency with which to look metrics depends upon the area of business. For example, inventory flows and manufacturing output should be looked at on a daily basis. Your sales pipeline, on the other hand, should be looked at on a weekly basis, and your financials should be looked at monthly.

Once a schedule has been established, the question is what to do with the data – how should the data be evaluated and when is it time to act? The reality is that there is no hard and fast answer to this question. When to act is dependent upon the type of business, its typical cycle, and the company itself. It is therefore important to develop a database that captures your metrics. This database should be updated with the same frequency that the data is collected (see above for suggested frequency). A historical database will enable you to quickly identify a data point that is deviating, positive or negative, from the historical. When this happens, it is time to act.

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

Whether it is a wholesale food distributor seeking guidance on how to define and execute corporate strategy; a telematics firm needing high quality content on a consistent basis; a real estate firm looking for a marketing partner; or a supply chain firm in need of interim management, our clients rely on Fronetics to help them navigate through critical junctures, meet their toughest challenges, and take advantage of opportunities. We deliver high-impact results.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

We have deep expertise and a proven track record in a broad range of industries including: supply chain, real estate, software, and logistics.

by Elizabeth Hines | Jul 13, 2015 | Big Data, Blog, Data/Analytics, Strategy, Supply Chain

Analytics is good for business — as long as you can make sense of it.

Does your business suffer from a case of data overload? Or do you steer clear of new investments in supply chain analytics because you are afraid they could yield more data than your business can handle? You are in good company.

Several recent surveys indicate companies either are wary of advanced analytics tools or say they have failed to leverage the technology. The issue does not seem to be a lack of knowledge of its existence or potential impact — end users are generally well informed — but how to absorb the data effectively and apply it across the entire organization.

According to a Telematics Update, for example, vendors would be wise to spend less time on their sales pitch and more time presenting the data in a digestible format, ensuring compatibility with the end user’s legacy systems, and aligning the solution with the end-user’s key performance indicators.

The challenge is also captured in an Accenture survey in which only one in five companies said they are “very satisfied” with the returns they have received from analytics. And it’s not for lack of trying. Two-thirds of companies have appointed a chief data officer in the last 18 months to oversee data management and analytics, while 71 percent of those who have not created such a position plan to do so in the near future.

This passage from Accenture’s survey report hits the nail on the head:

Companies wanting to compete more aggressively with analytics will move rapidly to industrialize the discipline on an enterprise-wide scale, redesigning how fact-based insights get embedded into key processes, leading to smarter decisions and better business outcomes.

Most organizations measure too many things that don’t matter, and don’t put sufficient focus on those things that do, establishing a large set of metrics, but often lacking a causal mapping of the key drivers of their business.

As the survey suggests, the move away from an isolated approach to an integrated cross-functional model may be the key to squeezing the most out of supply chain analytics. According to Deloitte, the key to delivering strategic insights is creating asingle authoritative data set from which all business units can draw information.

However, only 33% of the Accenture survey respondents said they are “aggressively using analytics across the entire enterprise.” Instead, highly customized data is often collected for units within the organization. A spending forecast by procurement may look nothing like its counterpart coming out of logistics. The inconsistency in reporting makes it hard to share the knowledge, and that takes us back to square one: lots of data and little useful information.

Jerry O’Dwyer, a principal with Deloitte Consulting, summed it up this way in a 2012 post:

If you are performing analytics in different areas of the supply chain — for example, spend analytics or demand planning — you may be missing opportunities that an expansive approach can yield. For companies of all kinds, in-depth supply chain analysis offers an opportunity to create increased value throughout their operations.

Let’s hear it: What do you think companies need to do to put analytics to effective use?

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

Whether it is a wholesale food distributor seeking guidance on how to define and execute corporate strategy; a telematics firm needing high quality content on a consistent basis; a real estate firm looking for a marketing partner; or a supply chain firm in need of interim management, our clients rely on Fronetics to help them navigate through critical junctures, meet their toughest challenges, and take advantage of opportunities. We deliver high-impact results.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

We have deep expertise and a proven track record in a broad range of industries including: supply chain, real estate, software, and logistics.

![Drowning in big data, parched for information [Infographic]](https://fronetics.com/wp-content/uploads/2024/10/big-data-2-1000x675.jpg)