by Elizabeth Hines | Jul 15, 2015 | Blog, Leadership, Strategy, Supply Chain

The sharing of tangible and intangible assets will increasingly become a fundamental feature of successful businesses.

The sharing of tangible and intangible assets will increasingly become a fundamental feature of successful businesses.

Few developments of late are as intriguing as the rise and disruptive impact of the collaborative economy. In a very short time, services that we may have thought of as permanent fixtures of our business and personal lives have been rendered obsolete by the sudden sharing of tangible and intangible assets in the peer-to-peer, business to consumer (B2C), and business to business (B2B) spheres.

B&B and hostels, car rental, and DVD rental are giving way to peer-to-peer accommodations, car sharing, and music and video streaming. The Marriott Hotel chain used the online platform LiquidSpace to convert empty conference rooms into rentable work spaces for guests as well as outside visitors. Walgreens teamed up with TaskRabbit, an online marketplace for outsourcing errands, to deliver products during flu season. The list is endless.

Rachel Botsman, an innovation strategist who has spent the past four years studying 500 collaborative economy startups worldwide, concludes in Harvard Business Review:

The real power of the collaborative economy is that it can serve as a zoom lens, offering a transformative perspective on the social, environmental, and economic value that can be created from any of a number of assets in ways and on a scale that did not exist before. In that transformation lie threats—and great opportunities.

While consumer sharing may have received the most media attention, Robert Vaughan, an economist at PwC Strategy & Inc., argues the open sharing of resources among businesses may present an even larger opportunity. Although, on the surface, it seems like an unlikely marriage – businesses do compete, after all – a growing number of successful collaborations prove Vaughan is right.

He writes:

In just a few years of activity, it has become clear that the unfettered exchange of otherwise unused major assets, including physical space and industrial equipment, allows a sharing company to operate more efficiently than its non-sharing rivals. Companies that go further still, wholeheartedly embracing the sharing of less tangible assets, may benefit from a different sort of change, one involving their culture, that builds new types of connections with, and sensitivity to, the world outside.

One example of an interesting collaboration involves General Electric and Quirky, an online inventor community. GE and other market giants such as IBM and Samsung file thousands of patents every year, most of which never move beyond the drawing board. The collaboration gives Quirky open access to GE’s patents, allowing for products that normally would not have been put to productive use – such as a smartphone controlled window air conditioner – to be brought to market.

Sometimes a direct collaboration may not even be necessary. A company may choose to place an undeveloped product on an online technology exchange, thereby opening itself to the possibility of building a connection to another company with complimentary expertise.

In many respects, enterprise sharing is still in its infancy and is likely to evolve just like Airbnb, whose concept seemed “fringe” when it launched in 2008 (it was initially marketed as a service for people to stay the night on their air beds in strangers’ homes). Now the company has amassed more than 650,000 rooms in 192 countries and threatens to disrupt not only the hotel industry but the entire hospitality sector.

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

Whether it is a wholesale food distributor seeking guidance on how to define and execute corporate strategy; a telematics firm needing high quality content on a consistent basis; a real estate firm looking for a marketing partner; or a supply chain firm in need of interim management, our clients rely on Fronetics to help them navigate through critical junctures, meet their toughest challenges, and take advantage of opportunities. We deliver high-impact results.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

We have deep expertise and a proven track record in a broad range of industries including: supply chain, real estate, software, and logistics.

by Elizabeth Hines | Jul 13, 2015 | Big Data, Blog, Data/Analytics, Strategy, Supply Chain

Analytics is good for business — as long as you can make sense of it.

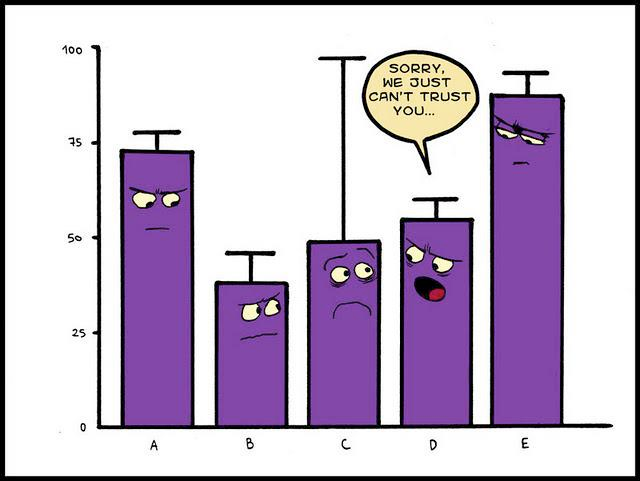

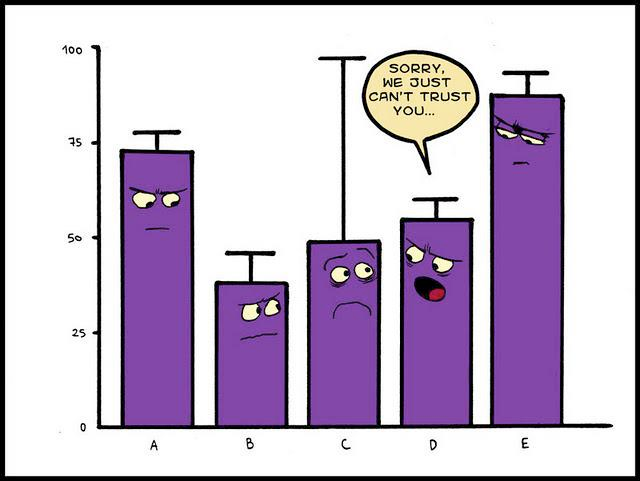

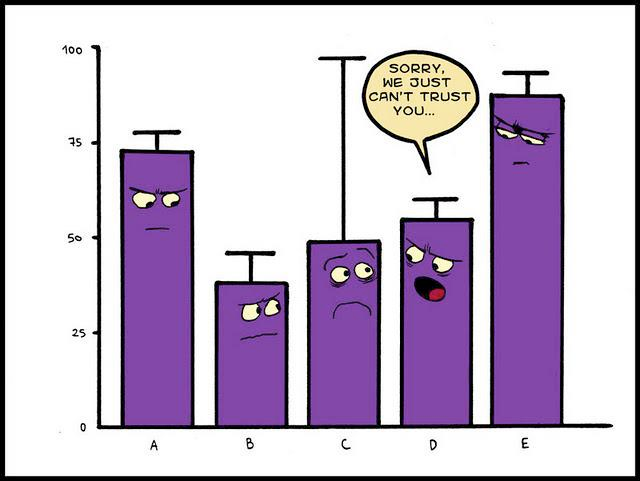

Does your business suffer from a case of data overload? Or do you steer clear of new investments in supply chain analytics because you are afraid they could yield more data than your business can handle? You are in good company.

Several recent surveys indicate companies either are wary of advanced analytics tools or say they have failed to leverage the technology. The issue does not seem to be a lack of knowledge of its existence or potential impact — end users are generally well informed — but how to absorb the data effectively and apply it across the entire organization.

According to a Telematics Update, for example, vendors would be wise to spend less time on their sales pitch and more time presenting the data in a digestible format, ensuring compatibility with the end user’s legacy systems, and aligning the solution with the end-user’s key performance indicators.

The challenge is also captured in an Accenture survey in which only one in five companies said they are “very satisfied” with the returns they have received from analytics. And it’s not for lack of trying. Two-thirds of companies have appointed a chief data officer in the last 18 months to oversee data management and analytics, while 71 percent of those who have not created such a position plan to do so in the near future.

This passage from Accenture’s survey report hits the nail on the head:

Companies wanting to compete more aggressively with analytics will move rapidly to industrialize the discipline on an enterprise-wide scale, redesigning how fact-based insights get embedded into key processes, leading to smarter decisions and better business outcomes.

Most organizations measure too many things that don’t matter, and don’t put sufficient focus on those things that do, establishing a large set of metrics, but often lacking a causal mapping of the key drivers of their business.

As the survey suggests, the move away from an isolated approach to an integrated cross-functional model may be the key to squeezing the most out of supply chain analytics. According to Deloitte, the key to delivering strategic insights is creating asingle authoritative data set from which all business units can draw information.

However, only 33% of the Accenture survey respondents said they are “aggressively using analytics across the entire enterprise.” Instead, highly customized data is often collected for units within the organization. A spending forecast by procurement may look nothing like its counterpart coming out of logistics. The inconsistency in reporting makes it hard to share the knowledge, and that takes us back to square one: lots of data and little useful information.

Jerry O’Dwyer, a principal with Deloitte Consulting, summed it up this way in a 2012 post:

If you are performing analytics in different areas of the supply chain — for example, spend analytics or demand planning — you may be missing opportunities that an expansive approach can yield. For companies of all kinds, in-depth supply chain analysis offers an opportunity to create increased value throughout their operations.

Let’s hear it: What do you think companies need to do to put analytics to effective use?

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

Whether it is a wholesale food distributor seeking guidance on how to define and execute corporate strategy; a telematics firm needing high quality content on a consistent basis; a real estate firm looking for a marketing partner; or a supply chain firm in need of interim management, our clients rely on Fronetics to help them navigate through critical junctures, meet their toughest challenges, and take advantage of opportunities. We deliver high-impact results.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

We have deep expertise and a proven track record in a broad range of industries including: supply chain, real estate, software, and logistics.

by Elizabeth Hines | Apr 8, 2015 | Blog, Leadership, Strategy

Mergers and acquisitions are increasingly popular strategies toward growth; however, 40% to 80% of mergers fail to meet objectives. M&A is complicated, and goes beyond simply “the process of buying a company.” At its heart it is a strategic selection of competencies that fill a void in a company’s offering, geography, technology, or industry area of focus. It’s wise to think about whether the time, money, and energy are ultimately going to pay off, literally and figuratively.

There are some critical things to consider before courting a merger or acquisition. Be a leader by asking the tougher questions internally rather than focusing your team on an outside “target”:

- Is there clarity around why a merger or acquisition is being considered? Will your organization reap strategic benefits or is this potential change only going to bring bonuses to the executives?

- Can your reorganization be better served by forming a strategic alliance instead? In this way, you get what you need without other non-strategic pieces that cloud merger and acquisition return on investment.

- Is there a licensing strategy that would work better than an acquisition strategy? Again, you can reach a beneficial goal without the expensive and time-consuming complications of a merger or acquisition.

- Are there other ways to access the marketplace, the capabilities, or the geography that you desire from the acquisition target?

After examining these questions, if the strategic decision points to a merger or acquisition, then strong leadership is critical. In the Deloitte report, The Leadership Premium, a survey of 400 stock market analysts ranked “senior leadership team effectiveness” as second only after “financial results” as the top criteria for judging company success. A detailed review of 94 different mergers revealed that leaders who oversaw a successful merger could:

- motivate others

- influence others

- build relationships

- develop others

- act with integrity

- show adaptability

- focus on customer needs

If acquiring leaders haven’t properly engaged with the target company before, during, and after an acquisition or merger, the likelihood of success declines. Confidence among employees of the acquiring and target companies can waiver throughout the acquisition process, and the same can happen during a merger. More than ever people will look to leadership for answers and guidance. Employees ask themselves: will I lose my job? Will I need to relocate? Will my position change? Will the workplace culture change? These answers will need to come, and for many employees, the earlier the better. A study found that “two of the top five most common reasons for M&A failure were down to management. These reasons were: poorly managed integration of people and culture (60%) and poorly managed integration of systems and processes (54%).”

From target identification to post-deal integration, leaders must become more involved with the steps necessary to make a merger or acquisition successful. Without such leaders, and their willingness to engage and guide, there could be no deal, or a very sour one.

by Elizabeth Hines | Apr 8, 2015 | Blog, Leadership, Strategy

Mergers and acquisitions are increasingly popular strategies toward growth; however, 40% to 80% of mergers fail to meet objectives. M&A is complicated, and goes beyond simply “the process of buying a company.” At its heart it is a strategic selection of competencies that fill a void in a company’s offering, geography, technology, or industry area of focus. It’s wise to think about whether the time, money, and energy are ultimately going to pay off, literally and figuratively.

There are some critical things to consider before courting a merger or acquisition. Be a leader by asking the tougher questions internally rather than focusing your team on an outside “target”:

- Is there clarity around why a merger or acquisition is being considered? Will your organization reap strategic benefits or is this potential change only going to bring bonuses to the executives?

- Can your reorganization be better served by forming a strategic alliance instead? In this way, you get what you need without other non-strategic pieces that cloud merger and acquisition return on investment.

- Is there a licensing strategy that would work better than an acquisition strategy? Again, you can reach a beneficial goal without the expensive and time-consuming complications of a merger or acquisition.

- Are there other ways to access the marketplace, the capabilities, or the geography that you desire from the acquisition target?

After examining these questions, if the strategic decision points to a merger or acquisition, then strong leadership is critical. In the Deloitte report, The Leadership Premium, a survey of 400 stock market analysts ranked “senior leadership team effectiveness” as second only after “financial results” as the top criteria for judging company success. A detailed review of 94 different mergers revealed that leaders who oversaw a successful merger could:

- motivate others

- influence others

- build relationships

- develop others

- act with integrity

- show adaptability

- focus on customer needs

If acquiring leaders haven’t properly engaged with the target company before, during, and after an acquisition or merger, the likelihood of success declines. Confidence among employees of the acquiring and target companies can waiver throughout the acquisition process, and the same can happen during a merger. More than ever people will look to leadership for answers and guidance. Employees ask themselves: will I lose my job? Will I need to relocate? Will my position change? Will the workplace culture change? These answers will need to come, and for many employees, the earlier the better. A study found that “two of the top five most common reasons for M&A failure were down to management. These reasons were: poorly managed integration of people and culture (60%) and poorly managed integration of systems and processes (54%).”

From target identification to post-deal integration, leaders must become more involved with the steps necessary to make a merger or acquisition successful. Without such leaders, and their willingness to engage and guide, there could be no deal, or a very sour one.

by Elizabeth Hines | Apr 6, 2015 | Big Data, Blog, Data/Analytics

Concurrent with the extraordinary rise of the Internet of Things (IoT), predictive analytics are gaining in popularity. With an increasing number of companies learning to master the precursors to developing predictive models — namely, connecting, monitoring, and analyzing — we can safely assume the art of gleaning business intelligence from foresight will continue to grow rapidly.

Indeed, Gartner analysts put forward that “few technology areas will have greater potential to improve the financial performance and position of a commercial global enterprise than predictive analytics.” And executives seem eager to jump on the bandwagon; in a survey of executives conducted by Accenture a full 88% indicated big data analytics is a top priority for their company. Amid the promises of predictive analytics, however, we also find a number of pitfalls. Some experts caution there are situations when predictive analytics techniques can prove inadequate, if not useless.

Here, we dissect three problems most commonly encountered by companies employing predictive analytics.

Past as a poor predictor of the future

The concept of predictive analytics is predicated on the assumption that future behavior can be more or less determined by examining past behaviors; that is, predictive analytics works well in a stable environment in which the future of the business is likely to resemble its past and present. But Harvard Business School professor Clayton Christensen points out that in the event of a major disruption, the past will do a poor job of foreshadowing future events. As an example, he cites the advent of PCs and commodity servers, arguing computer vendors who specialized in minicomputers in the 1980s couldn’t possibly have predicted their sales impact, since they were innovations and there was no data to analyze.

Interpreting bias

Consider also the bias in favor of a positive result when interpreting data for predictive purposes; it is one of the most common errors in predictive analytics projects. Speaking at the 2014 Predictive Analytics World conference in Boston, John Elder, president of consulting firm Elder Research, Inc., made a good point when he noted that people “‘often look for data to justify our decisions,’ when it should be the other way around.”

Collecting and analyzing unhelpful or superfluous data

Failure to tie data efforts to operational processes can lead to an unnecessary drain of staff resources. Mining big data will do little good if the insights are not directly tied to functional procedures. More companies than we probably realize are wasting precious time and manpower on big data projects that are not adequately understood, producing trivia rather than actionable business intelligence.

To overcome these common pitfalls of predictive analytics, spend some time reviewing the sources of your data and the basic assumptions on which your predictive analytics projects are based. Because the major principle of predictive analytics is that the past behavior can forecast future behavior, keep your ear to the ground for growing industry trends or any other factors that might influence consumer behavior. Plan to revisit the source of your data frequently to determine if the sample set is representative of your future set and should continue to be used. Most importantly, regularly evaluate how your predictive analysis relates and contributes to your company’s overall goals and objectives.

What else do you think organizations can do to ward off the snags of predictive data analysis and use foresight more effectively?

The sharing of tangible and intangible assets will increasingly become a fundamental feature of successful businesses.

The sharing of tangible and intangible assets will increasingly become a fundamental feature of successful businesses.